Pegasystems PEGACPDS88V1 Certified Pega Data Scientist 8.8 Exam Practice Test

From two churn models with the similar performance, we chose the one the_____

Answer : D

The principle of parsimony states that from two models with similar performance, we choose the one with the fewest number of predictors. This is because a simpler model is easier to understand, maintain, and deploy. Reference: https://academy.pega.com/module/predictive-analytics/topic/evaluating-predictive-models

A contact center application recommends relevant actions for each customer. The business team wants to know the possible ways in which these actions can be ordered so that the contact center agent can discuss one proposition at a time, starting from the top.

As a strategy designer, what are your two options if you use a Prioritize component to order the actions? (Choose Two)

Answer : C, D

The prioritize component is used to order actions based on a numerical value, such as priority, propensity, or custom expression. You can choose to sort the actions in descending or ascending order. Reference: https://academy.pega.com/module/creating-and-understanding-decision-strategies-archived/topic/prioritizing-actions

Which statement about predictive models is true?

Answer : A

Predictive models need historical data to be created. Predictive models are statistical models that use historical data to learn patterns and trends and make predictions for future outcomes. Predictive models can be built with Pega machine learning or imported from third-party tools such as PMML or H2O. Reference: https://community.pega.com/sites/default/files/help_v82/procomhelpmain.htm#rule-/rule-decision-/rule-decision-predictivemodel/main.htm

When selecting the list of predictors for an adaptive model you should

Answer : B

When selecting the list of predictors for an adaptive model you should consider properties from a wide range of sources. Predictors are properties that influence the customer behavior and can be derived from various sources such as customer profile, interaction history, proposition details, etc. Reference: https://community.pega.com/sites/default/files/help_v82/procomhelpmain.htm#rule-/rule-decision-/rule-decision-adaptivemodel/main.htm

When building a predictive model, the use of testing and validation samples_______________

Answer : A

The use of testing and validation samples increases the accuracy of predictive models by allowing you to evaluate how well they perform on unseen data and avoid overfitting or underfitting problems. Reference: https://academy.pega.com/module/predictive-analytics/topic/creating-predictive-models

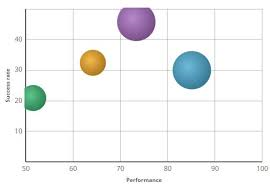

U+ Insurance uses Pega Process AI to route complex claims to an expert. As a data scientist, you have used the wizard to create a prediction with Case completion as the outcome to help with decision routing. You are tasked with monitoring the adaptive models. When you open the monitoring tab of the adaptive model rule, you see the following chart:

In this scenario, the system creates an adaptive model for each

Answer : B

In this scenario, the system creates an adaptive model for each case type, such as claim or complaint. The adaptive model learns from the outcomes of each case type and predicts the probability of case completion for each customer. Reference: https://academy.pega.com/module/predicting-customer-behavior-using-real-time-data-archived/topic/adaptive-models-case-management

When defining outcomes for an Adaptive Model you must define

Answer : C

When defining outcomes for an adaptive model, you must define one or more positive behavior values, which indicate that the customer accepted or responded to the offer. You can also define negative and neutral behavior values, but they are optional. Reference: https://academy.pega.com/module/predicting-customer-behavior-using-real-time-data-archived/topic/configuring-adaptive-models