CIPS L6M2 Global Commercial Strategy Exam Practice Test

SIMULATION

Explain the use of forward and future contracts in the commodities market

Answer : A

Use of Forward and Futures Contracts in the Commodities Market

Introduction

The commodities market involves the trading of physical goods such as oil, gold, agricultural products, and metals. Due to price volatility, businesses and investors use derivative contracts like forward and futures contracts to manage price risk and ensure stability in supply chains.

Both contracts allow buyers and sellers to agree on a fixed price for a future date, but they differ in terms of standardization, trading methods, and risk exposure.

1. Forward Contracts (Private, Custom Agreements)

Definition

A forward contract is a customized agreement between two parties to buy or sell a commodity at a specified price on a future date. It is a private, over-the-counter (OTC) contract, meaning it is not traded on an exchange.

Key Characteristics:

Customizable terms (quantity, delivery date, price).

Direct agreement between buyer and seller.

Used for hedging against price fluctuations.

Example: A coffee producer agrees to sell 10,000kg of coffee to a distributor in 6 months at a fixed price of $5 per kg, protecting both parties from price swings.

Advantages of Forward Contracts

Tailored to buyer/seller needs -- Customizable quantity, quality, and delivery terms.

Reduces price uncertainty -- Locks in a price, protecting against market fluctuations.

No upfront cost -- No initial margin or collateral required.

Disadvantages of Forward Contracts

High counterparty risk -- If one party defaults, the other may face financial losses.

Not regulated or publicly traded -- Higher risk of contract disputes.

Limited liquidity -- Harder to transfer or sell compared to futures contracts.

Best for: Companies looking for customized price protection in procurement or sales (e.g., food manufacturers, oil refineries).

2. Futures Contracts (Standardized, Exchange-Traded Agreements)

Definition

A futures contract is a standardized agreement to buy or sell a commodity at a predetermined price on a future date. These contracts are traded on organized exchanges (e.g., Chicago Mercantile Exchange (CME), London Metal Exchange (LME)).

Key Characteristics:

Highly regulated and standardized (fixed contract sizes and terms).

Exchange-traded Increased liquidity and price transparency.

Requires initial margin and daily settlements (mark-to-market system).

Example: A wheat farmer uses futures contracts on the Chicago Board of Trade (CBOT) to lock in wheat prices before harvest, avoiding potential price drops.

Advantages of Futures Contracts

Lower counterparty risk -- Exchanges guarantee contract settlement.

High liquidity -- Easily bought or sold on futures markets.

Price transparency -- Publicly available pricing and standardized contracts.

Disadvantages of Futures Contracts

Less flexibility -- Fixed contract sizes and expiration dates.

Margin requirements -- Traders must maintain a margin account, requiring cash reserves.

Potential for speculative losses -- Prices fluctuate daily, leading to possible margin calls.

Best for: Large-scale buyers/sellers, investors, and companies needing risk management in commodity markets.

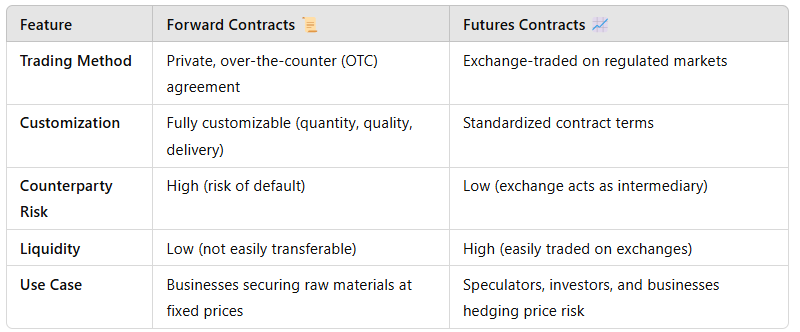

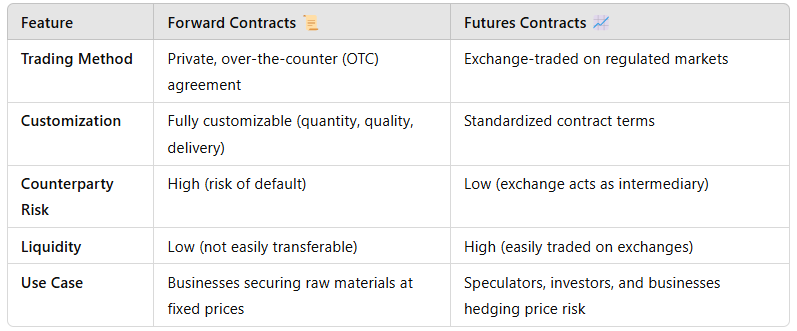

3. Key Differences Between Forward and Futures Contracts

Key Takeaway: Forwards offer flexibility but higher risk, while futures provide standardization and liquidity.

4. Application of Forward and Futures Contracts in the Commodities Market

Forwards Used By:

Food manufacturers -- Locking in wheat, sugar, or coffee prices for future production.

Oil refineries -- Securing crude oil prices to manage fuel costs.

Mining companies -- Pre-agreeing on metal prices to secure revenue streams.

Futures Used By:

Airlines -- Hedging against fluctuating fuel prices.

Investors -- Speculating on gold, oil, or agricultural prices for profit.

Governments -- Stabilizing national food or energy reserves.

5. Conclusion

Both forward and futures contracts are essential tools in the commodities market for price risk management.

Forward contracts are customizable but riskier, making them suitable for businesses with specific procurement needs.

Futures contracts offer liquidity and reduced counterparty risk, making them ideal for investors and large corporations managing price volatility.

Organizations must choose the right contract based on their risk tolerance, market exposure, and financial objectives.

SIMULATION

Explain 5 reasons why exchange rates can be volatile

Five Reasons Why Exchange Rates Can Be Volatile

Introduction

Exchange rates are constantly fluctuating due to economic, political, and market forces. Volatility in exchange rates affects global trade, procurement costs, and business profitability. Companies engaged in international supply chains or global expansion must understand the factors that drive currency fluctuations to manage risks effectively.

This answer explores five key reasons why exchange rates experience volatility.

1. Interest Rate Differentials (Monetary Policy Impact)

Explanation

Central banks set interest rates to control inflation and economic growth. Countries with higher interest rates attract foreign investment, increasing demand for their currency.

How It Causes Volatility?

Rising interest rates Attracts foreign investors Currency appreciates

Falling interest rates Reduces investment appeal Currency depreciates

Example: When the US Federal Reserve raises interest rates, the US dollar strengthens as investors move capital to USD-based assets.

Key Takeaway: Exchange rates fluctuate as investors adjust capital flows based on interest rate expectations.

2. Inflation Rates (Purchasing Power Impact)

Explanation

Inflation reduces the value of money, leading to lower purchasing power. Countries with high inflation tend to see their currency weaken, while those with low inflation maintain a stronger currency.

How It Causes Volatility?

High inflation Reduces confidence in currency Depreciation

Low inflation Increases currency stability Appreciation

Example: The Turkish Lira has depreciated significantly due to high inflation rates, making imports expensive.

Key Takeaway: Inflation affects the real value of money, influencing exchange rate stability.

3. Speculation and Market Sentiment (Investor Behavior Impact)

Explanation

Foreign exchange markets (Forex) are driven by investor speculation. Traders buy and sell currencies based on market trends, geopolitical risks, and economic forecasts.

How It Causes Volatility?

If investors expect a currency to strengthen, they buy more Increases demand and value

If investors lose confidence, they sell off holdings Causes depreciation

Example: In 2016, after the Brexit referendum, speculation about the UK economy caused the British pound (GBP) to drop sharply.

Key Takeaway: Investor behavior and speculation create short-term exchange rate volatility.

4. Political Instability & Economic Uncertainty (Government Policies & Geopolitics)

Explanation

Political uncertainty and economic instability weaken investor confidence, leading to capital flight from riskier currencies. Countries with stable governments and strong economies maintain more stable exchange rates.

How It Causes Volatility?

Political crises, elections, or policy changes Uncertainty Currency depreciation

Stable governance and economic reforms Confidence Currency appreciation

Example:

Argentina's peso lost value due to economic instability and high debt.

Switzerland's Swiss Franc (CHF) remains strong due to political stability and its reputation as a "safe-haven" currency.

Key Takeaway: Political and economic uncertainty increase exchange rate volatility by influencing investor confidence.

5. Trade Balances & Current Account Deficits (Export-Import Impact)

Explanation

The balance of trade (exports vs. imports) impacts currency demand. Countries that export more than they import experience higher demand for their currency, leading to appreciation. Conversely, nations with large trade deficits see their currencies depreciate.

How It Causes Volatility?

Trade surplus (more exports) Demand for local currency rises Appreciation

Trade deficit (more imports) Increased need for foreign currency Depreciation

Example:

China's trade surplus strengthens the Chinese Yuan (CNY).

The US dollar fluctuates based on its import-export trade balance.

Key Takeaway: Exchange rates shift as global trade patterns change, affecting currency demand.

Conclusion

Exchange rate volatility is driven by economic, financial, and political factors:

1 Interest Rates -- Higher rates attract investment, strengthening currency.

2 Inflation Rates -- High inflation erodes value, weakening currency.

3 Speculation & Market Sentiment -- Investor behavior influences short-term fluctuations.

4 Political & Economic Uncertainty -- Instability causes capital flight and depreciation.

5 Trade Balances & Deficits -- Export-driven economies see appreciation, while import-heavy nations experience depreciation.

Understanding these drivers helps businesses manage currency risks when engaging in global procurement, contracts, and financial planning.

Answer : A

Use of Forward and Futures Contracts in the Commodities Market

Introduction

The commodities market involves the trading of physical goods such as oil, gold, agricultural products, and metals. Due to price volatility, businesses and investors use derivative contracts like forward and futures contracts to manage price risk and ensure stability in supply chains.

Both contracts allow buyers and sellers to agree on a fixed price for a future date, but they differ in terms of standardization, trading methods, and risk exposure.

1. Forward Contracts (Private, Custom Agreements)

Definition

A forward contract is a customized agreement between two parties to buy or sell a commodity at a specified price on a future date. It is a private, over-the-counter (OTC) contract, meaning it is not traded on an exchange.

Key Characteristics:

Customizable terms (quantity, delivery date, price).

Direct agreement between buyer and seller.

Used for hedging against price fluctuations.

Example: A coffee producer agrees to sell 10,000kg of coffee to a distributor in 6 months at a fixed price of $5 per kg, protecting both parties from price swings.

Advantages of Forward Contracts

Tailored to buyer/seller needs -- Customizable quantity, quality, and delivery terms.

Reduces price uncertainty -- Locks in a price, protecting against market fluctuations.

No upfront cost -- No initial margin or collateral required.

Disadvantages of Forward Contracts

High counterparty risk -- If one party defaults, the other may face financial losses.

Not regulated or publicly traded -- Higher risk of contract disputes.

Limited liquidity -- Harder to transfer or sell compared to futures contracts.

Best for: Companies looking for customized price protection in procurement or sales (e.g., food manufacturers, oil refineries).

2. Futures Contracts (Standardized, Exchange-Traded Agreements)

Definition

A futures contract is a standardized agreement to buy or sell a commodity at a predetermined price on a future date. These contracts are traded on organized exchanges (e.g., Chicago Mercantile Exchange (CME), London Metal Exchange (LME)).

Key Characteristics:

Highly regulated and standardized (fixed contract sizes and terms).

Exchange-traded Increased liquidity and price transparency.

Requires initial margin and daily settlements (mark-to-market system).

Example: A wheat farmer uses futures contracts on the Chicago Board of Trade (CBOT) to lock in wheat prices before harvest, avoiding potential price drops.

Advantages of Futures Contracts

Lower counterparty risk -- Exchanges guarantee contract settlement.

High liquidity -- Easily bought or sold on futures markets.

Price transparency -- Publicly available pricing and standardized contracts.

Disadvantages of Futures Contracts

Less flexibility -- Fixed contract sizes and expiration dates.

Margin requirements -- Traders must maintain a margin account, requiring cash reserves.

Potential for speculative losses -- Prices fluctuate daily, leading to possible margin calls.

Best for: Large-scale buyers/sellers, investors, and companies needing risk management in commodity markets.

3. Key Differences Between Forward and Futures Contracts

Key Takeaway: Forwards offer flexibility but higher risk, while futures provide standardization and liquidity.

4. Application of Forward and Futures Contracts in the Commodities Market

Forwards Used By:

Food manufacturers -- Locking in wheat, sugar, or coffee prices for future production.

Oil refineries -- Securing crude oil prices to manage fuel costs.

Mining companies -- Pre-agreeing on metal prices to secure revenue streams.

Futures Used By:

Airlines -- Hedging against fluctuating fuel prices.

Investors -- Speculating on gold, oil, or agricultural prices for profit.

Governments -- Stabilizing national food or energy reserves.

5. Conclusion

Both forward and futures contracts are essential tools in the commodities market for price risk management.

Forward contracts are customizable but riskier, making them suitable for businesses with specific procurement needs.

Futures contracts offer liquidity and reduced counterparty risk, making them ideal for investors and large corporations managing price volatility.

Organizations must choose the right contract based on their risk tolerance, market exposure, and financial objectives.

SIMULATION

XYX is an airline whose profits have been severely affected due to not being able to operate during a two-year pandemic. Cash reserves at the organisation are at an all time low and XYZ are looking into sources of short-term funding for working capital. Discuss four sources and suggest which one XYZ should use.

Answer : A

Sources of Short-Term Funding for XYZ Airline

Introduction

XYZ, an airline with severe financial losses due to a two-year pandemic, requires short-term funding to maintain operations. With cash reserves at an all-time low, the airline needs immediate working capital to cover employee salaries, aircraft maintenance, airport fees, and fuel costs.

Short-term funding options provide temporary liquidity but come with different risks and costs. This answer evaluates four sources of short-term funding and recommends the best option for XYZ.

1. Bank Overdraft (Flexible Borrowing Facility)

Explanation

A bank overdraft allows XYZ to withdraw funds beyond its available balance, up to a set limit.

Advantages

Flexible borrowing -- Funds can be accessed as needed.

Quick to arrange -- Available through existing bank relationships.

Interest only on borrowed amount -- No need to take a large loan upfront.

Disadvantages

High-interest rates -- Overdrafts often have higher interest than standard loans.

Limited borrowing capacity -- May not be enough to cover all costs.

Bank may demand repayment at short notice.

Best for: Covering minor cash flow shortages but not large-scale operational funding.

2. Short-Term Business Loan (Fixed-Term Borrowing from a Bank or Lender)

Explanation

A short-term loan provides a lump sum of cash that XYZ must repay over a set period (typically 3-12 months).

Advantages

Larger funding amounts available -- More substantial than overdrafts.

Predictable repayment terms -- Fixed monthly payments help with planning.

Can be secured or unsecured -- Secured loans offer lower interest rates.

Disadvantages

Requires repayment even if revenue is still low.

Potentially high interest rates, especially for unsecured loans.

Approval process may take time.

Best for: Covering larger operational costs like aircraft maintenance and staff salaries.

3. Sale and Leaseback of Assets (Liquidity from Selling Existing Assets)

Explanation

XYZ can sell its aircraft or other assets to an investor or leasing company and then lease them back for continued use.

Advantages

Immediate cash injection without losing operational assets.

No repayment burden -- Unlike loans, it does not increase debt levels.

Improves cash flow for essential expenses.

Disadvantages

Long-term cost increase -- Leasing is more expensive than owning in the long run.

Loss of asset ownership -- Limits financial flexibility in the future.

Dependent on market conditions -- Aircraft resale values fluctuate.

Best for: Raising large capital quickly while continuing operations.

4. Government Grants or Emergency Aid (Public Sector Financial Assistance)

Explanation

Governments often provide financial aid or grants to struggling industries, especially airlines affected by global crises.

Advantages

No repayment required -- Unlike loans, grants do not need to be repaid.

Low risk -- Does not increase financial liabilities.

Supports industry stability -- Governments want airlines to survive for economic reasons.

Disadvantages

Lengthy approval process -- Bureaucratic delays may not provide immediate relief.

Strict eligibility requirements -- XYZ must meet conditions set by the government.

Potential public criticism -- Bailouts may attract negative media attention.

Best for: Long-term financial recovery rather than immediate short-term cash flow issues.

5. Recommendation: Best Source for XYZ

Recommended Option: Sale and Leaseback of Assets

Why?

Provides immediate liquidity -- Essential for covering urgent operational costs.

No additional debt burden -- Unlike loans, it does not create financial liabilities.

Ensures business continuity -- XYZ can still operate leased aircraft.

Secondary Option: Short-Term Loan

If sale and leaseback is not viable, a short-term business loan can be used for emergency liquidity, but it increases financial risk.

Final Takeaway:

Sale and Leaseback Best for quick large-scale funding without debt.

Short-Term Loan A backup option if leasing is unavailable.

SIMULATION

Describe four drivers of internationalisation

Answer : A

Four Key Drivers of Internationalisation

Introduction

Internationalisation refers to the process of expanding business operations into international markets. Companies expand globally to increase market share, access resources, reduce costs, and enhance competitiveness.

Several factors drive internationalisation, but the four key drivers are:

Market Drivers -- Demand from global consumers.

Cost Drivers -- Reducing production costs.

Competitive Drivers -- Gaining an edge over rivals.

Government & Regulatory Drivers -- Trade policies and incentives.

These factors influence business strategy, supply chain management, and operational efficiency in international markets.

1. Market Drivers (Demand and Market Expansion)

Definition

Market drivers relate to consumer demand, global branding opportunities, and standardization of products across different markets.

Why It Drives Internationalisation?

Companies seek new customers and revenue streams beyond domestic markets.

Global branding creates strong market presence and customer loyalty.

Similar customer preferences allow for product standardization and scalability.

Example: McDonald's expands globally by offering consistent branding and adapted menus to match local tastes.

Key Takeaway: Businesses expand internationally to tap into new markets, increase sales, and leverage brand recognition.

2. Cost Drivers (Reducing Production and Operational Costs)

Definition

Cost drivers involve reducing manufacturing, labor, and supply chain costs by operating in lower-cost regions.

Why It Drives Internationalisation?

Labor cost savings -- Companies move production to low-cost countries (e.g., China, Vietnam, Mexico).

Economies of scale -- Expanding operations globally lowers per-unit costs.

Access to cheaper raw materials -- Firms relocate to resource-rich countries for lower procurement costs.

Example: Apple manufactures iPhones in China due to lower labor costs and supplier proximity.

Key Takeaway: Companies internationalise to optimize costs, increase profit margins, and improve supply chain efficiency.

3. Competitive Drivers (Gaining Market Advantage)

Definition

Competitive drivers push firms to expand internationally to stay ahead of rivals, access new technologies, and strengthen market positioning.

Why It Drives Internationalisation?

Competing with global players forces firms to expand or risk losing market share.

First-mover advantage -- Entering new markets early builds brand dominance.

Access to innovation -- Expanding to regions with advanced R&D and skilled talent enhances competitiveness.

Example: Tesla expanded into China to compete with local EV manufacturers and dominate the world's largest electric vehicle market.

Key Takeaway: Businesses internationalise to outperform competitors, access innovation, and capture strategic markets.

4. Government & Regulatory Drivers (Trade Policies & Incentives)

Definition

Government policies, trade agreements, and financial incentives influence how and where businesses expand internationally.

Why It Drives Internationalisation?

Free Trade Agreements (FTAs) reduce tariffs, making exports/imports more attractive.

Government incentives (e.g., tax breaks, subsidies) encourage foreign investments.

Favorable regulations allow easier market entry and operations.

Example: Car manufacturers set up plants in Mexico due to NAFTA trade benefits and lower import tariffs into North America.

Key Takeaway: Businesses internationalise when government policies support market entry, trade facilitation, and investment incentives.

Conclusion

Internationalisation is driven by market demand, cost efficiencies, competitive pressures, and regulatory factors. Companies expand globally to:

Access new customers and increase revenue.

Reduce costs through cheaper production and labor.

Stay competitive and gain market leadership.

Leverage government trade policies for easier market entry.

Understanding these drivers helps businesses make informed global expansion decisions while managing risks effectively.

SIMULATION

XYZ is a successful cake manufacturer and wishes to expand the business to create additional confectionary items. The expansion will require the purchase of a further manufacturing facility, investment in machinery and the hiring of more staff. The CEO and CFO are confident that the diversification will be a success and are discussing ways to raise funding for the expansion and are debating between dept funding and funding. What are the advantages and disadvantages of each approach?

Answer : A

Evaluation of Debt Funding vs. Equity Funding for XYZ's Expansion

Introduction

As XYZ, a successful cake manufacturer, plans to expand into additional confectionery items, it requires significant investment in a new manufacturing facility, machinery, and staff. To finance this expansion, the company must choose between:

Debt Funding -- Borrowing from banks or financial institutions.

Equity Funding -- Raising capital by selling shares to investors.

Each funding option has advantages and disadvantages that impact financial stability, ownership control, and long-term business strategy.

1. Debt Funding (Loans, Bonds, or Credit Facilities)

Definition

Debt funding involves borrowing money from banks, lenders, or issuing corporate bonds, which must be repaid with interest.

Key Characteristics:

The company retains full ownership and decision-making control.

Loan repayments are fixed and predictable.

Interest payments are tax-deductible.

Example: XYZ takes a bank loan of 2 million to purchase new machinery and repay it over five years with interest.

Advantages of Debt Funding

Ownership Retention -- XYZ keeps full control over business decisions.

Predictable Repayment Plan -- Fixed monthly payments make financial planning easier.

Tax Benefits -- Interest payments reduce taxable income.

Shorter-Term Obligation -- Once the loan is repaid, there are no further obligations.

Disadvantages of Debt Funding

Repayment Pressure -- Regular repayments increase financial risk during slow sales periods.

Interest Costs -- High-interest rates can reduce profitability.

Collateral Requirement -- Lenders may require company assets as security.

Credit Risk -- If XYZ fails to repay, it risks losing assets or damaging credit ratings.

Best for: Companies that want to maintain ownership and have stable revenue streams to cover repayments.

2. Equity Funding (Selling Shares to Investors or Venture Capitalists)

Definition

Equity funding involves raising capital by selling shares in the company to investors, such as private investors, venture capitalists, or the stock market.

Key Characteristics:

No repayment obligations, but shareholders expect a return on investment (ROI).

Investors gain partial ownership and may influence business decisions.

Funding amount depends on the company's valuation and investor interest.

Example: XYZ sells 20% of its shares to a private investor for 3 million, which funds new production lines.

Advantages of Equity Funding

No Repayment Obligation -- Reduces financial burden on cash flow.

Access to Large Capital -- Easier to raise significant funds for expansion.

Attracts Strategic Investors -- Investors may provide expertise and industry connections.

Spreads Business Risk -- Losses are shared with investors, reducing pressure on XYZ.

Disadvantages of Equity Funding

Loss of Ownership & Control -- Investors gain a say in company decisions.

Profit Sharing -- Dividends or profit-sharing reduce earnings for existing owners.

Longer Decision-Making Process -- Raising equity capital takes time due to negotiations and regulatory compliance.

Dilution of Shares -- Selling shares reduces the founder's ownership percentage.

Best for: Companies needing large funding amounts with less repayment pressure, but willing to share ownership and decision-making.

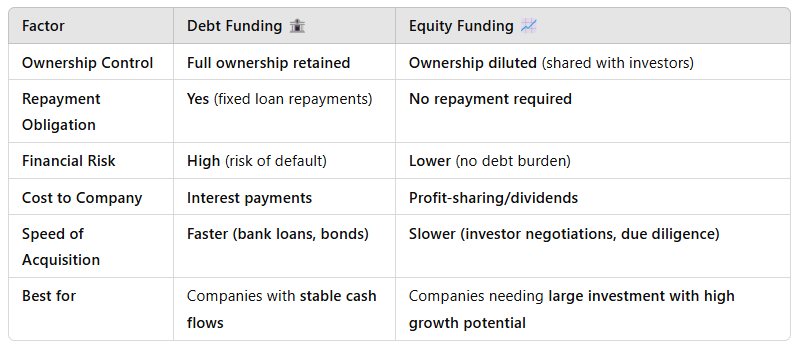

3. Comparison: Debt vs. Equity Funding

Key Takeaway: The choice between debt and equity funding depends on XYZ's risk tolerance, cash flow stability, and long-term growth strategy.

4. Conclusion & Recommendation

Both debt funding and equity funding offer advantages and risks for XYZ's expansion.

Debt funding is ideal if XYZ wants to retain ownership and has stable revenue to cover loan repayments.

Equity funding is better if XYZ seeks larger investments, strategic expertise, and reduced financial risk.

Recommended Approach: A hybrid strategy, combining debt for short-term capital needs and equity for long-term growth, can provide financial flexibility while minimizing risks.

SIMULATION

Explain the characteristics of strategic decisions. At what level of a business are strategic decisions made and why?

Answer : A

Characteristics of Strategic Decisions

Strategic decisions are long-term, high-impact choices that shape a company's future direction. These decisions differ from operational and tactical decisions in several key ways:

Long-Term Focus -- Strategic decisions determine the future direction of a business, often spanning several years.

Example: A company deciding to expand into international markets.

Significant Impact -- They affect the entire organization, influencing growth, profitability, and market positioning.

Example: A shift from a brick-and-mortar retail model to an e-commerce-based approach.

Resource Intensive -- They require large financial, human, and technological resources to implement.

Example: Investing in AI-driven supply chain automation.

High Risk and Uncertainty -- These decisions involve considerable risks due to market changes, competition, and external factors.

Example: Entering an emerging market with regulatory and political risks.

Difficult to Reverse -- Strategic decisions are not easily changed without significant costs or consequences.

Example: Mergers and acquisitions require extensive planning and are challenging to undo.

Cross-Functional Involvement -- They require input from multiple departments (finance, marketing, operations, IT).

Example: A new product launch involves R&D, marketing, supply chain, and finance teams.

Aimed at Gaining Competitive Advantage -- The goal is to improve the company's market position and long-term success.

Example: Tesla's focus on electric vehicle technology and charging infrastructure.

At What Level Are Strategic Decisions Made?

Strategic decisions are made at the corporate and business levels, typically by senior management and executives. The three levels of decision-making in a company are:

1. Corporate-Level Decisions (Top Management)

Made by the CEO, Board of Directors, and Senior Executives.

Concerned with the overall direction of the company.

Focuses on long-term objectives, market expansion, mergers & acquisitions.

Example: Amazon's decision to acquire Whole Foods to expand into the grocery industry.

2. Business-Level Decisions (Middle Management)

Made by Divisional Heads, Business Unit Managers, and Senior Functional Leaders.

Focuses on how to compete effectively within a specific industry or market.

Covers areas such as pricing, product differentiation, and operational efficiency.

Example: Netflix shifting from a DVD rental business to a streaming service.

3. Functional-Level Decisions (Operational Managers)

Made by Department Heads, Operational Managers, and Team Leaders.

Concerned with day-to-day implementation of strategic and business-level plans.

Focuses on efficiency, productivity, and execution of company strategy.

Example: A supply chain manager optimizing inventory levels to reduce costs.

Why Are Strategic Decisions Made at the Corporate and Business Levels?

Require Vision and Expertise -- Senior executives have the big-picture perspective needed for long-term planning.

Affect the Entire Organization -- These decisions impact multiple departments, requiring cross-functional coordination.

High-Risk and Costly -- Strategic choices involve financial investments, brand reputation, and market positioning.

Long-Term Focus -- Corporate-level leaders ensure that decisions align with the company's mission, vision, and goals.

Conclusion

Strategic decisions shape the company's future, requiring careful planning, significant investment, and risk assessment. They are made at the corporate and business levels because they impact the entire organization, require expert leadership, and have long-term consequences.

SIMULATION

Describe 5 strategic decisions a company can make and how these decisions could impact upon competitive advantage.

Answer : A

Five Strategic Decisions a Company Can Make and Their Impact on Competitive Advantage

Strategic decisions shape a company's direction and influence its long-term success. Below are five key strategic decisions and their impact on competitive advantage:

1. Market Entry Strategy

Decision: A company decides how to enter new markets (e.g., direct investment, joint ventures, exporting, franchising).

Impact on Competitive Advantage:

Global Reach: Expanding into new markets increases revenue streams and reduces dependency on a single market.

Risk Mitigation: Entering via joint ventures or alliances can reduce risks related to market unfamiliarity.

Brand Positioning: Choosing premium vs. cost-leadership entry strategies can establish market dominance.

Potential Risk: Poor market research can lead to financial loss and reputational damage.

Example: Tesla entering China through direct investment in Gigafactories to strengthen its supply chain and reduce production costs.

2. Supply Chain Strategy

Decision: Whether to adopt a globalized, localized, or hybrid supply chain model.

Impact on Competitive Advantage:

Cost Reduction: Strategic sourcing from low-cost countries lowers production expenses.

Resilience: A diverse supplier base reduces risks of disruptions (e.g., geopolitical risks, pandemics).

Speed to Market: Nearshoring strategies improve lead times and response to demand fluctuations.

Potential Risk: Over-reliance on global suppliers can lead to disruptions (e.g., semiconductor shortages).

Example: Apple's dual sourcing strategy for chip manufacturing (Taiwan's TSMC + US-based suppliers) improves resilience.

3. Innovation and R&D Investment

Decision: How much to invest in research and development (R&D) to drive product innovation.

Impact on Competitive Advantage:

Differentiation: Unique and high-quality products create strong brand loyalty (e.g., iPhones, Tesla).

First-Mover Advantage: Innovators set industry trends, making it difficult for competitors to catch up.

Revenue Growth: New technologies create additional revenue streams (e.g., SaaS models in tech).

Potential Risk: High R&D costs with no guaranteed success (e.g., Google Glass failure).

Example: Pfizer and BioNTech's rapid COVID-19 vaccine development, giving them first-mover advantage.

4. Pricing Strategy

Decision: Whether to compete on cost leadership, differentiation, or premium pricing.

Impact on Competitive Advantage:

Market Penetration: Low-cost pricing attracts price-sensitive customers (e.g., Walmart, Ryanair).

Brand Exclusivity: Premium pricing enhances brand perception and profitability (e.g., Rolex, Louis Vuitton).

Value-Based Pricing: Aligning price with perceived value increases customer retention.

Potential Risk: A race to the bottom in pricing wars can erode profit margins (e.g., budget airlines struggle with profitability).

Example: Apple uses a premium pricing strategy while Xiaomi competes via cost leadership in smartphones.

5. Digital Transformation Strategy

Decision: Investment in automation, AI, and digital platforms to improve efficiency and customer engagement.

Impact on Competitive Advantage:

Operational Efficiency: Automation reduces costs and increases productivity (e.g., Amazon's AI-driven warehouses).

Customer Experience: AI-driven personalization improves engagement (e.g., Netflix's recommendation algorithms).

Scalability: Digital platforms enable rapid global expansion (e.g., Shopify helping SMEs go digital).

Potential Risk: High initial investment with slow ROI; risk of cyber threats.

Example: Starbucks using AI-powered personalization and mobile ordering to increase sales and customer loyalty.

Conclusion

Each strategic decision influences a company's competitive positioning. The most successful companies align market expansion, supply chain strategies, innovation, pricing, and digital transformation to create a sustainable competitive advantage.