CIPS L5M4 Advanced Contract and Financial Management Exam Practice Test

SIMULATION

Describe 5 parts of the analysis model, first put forward by Porter, in which an organisation can assess the competitive marketplace (25 marks)

Answer : A

The analysis model referred to in the question is Porter's Five Forces, a framework developed by Michael Porter to assess the competitive environment of an industry and understand the forces that influence an organization's ability to compete effectively. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, Porter's Five Forces is a strategic tool used to analyze the marketplace to inform procurement decisions, supplier selection, and contract strategies, ensuring financial and operational efficiency. Below are the five parts of the model, explained in detail:

Threat of New Entrants:

Description: This force examines how easy or difficult it is for new competitors to enter the market. Barriers to entry (e.g., high capital requirements, brand loyalty, regulatory restrictions) determine the threat level.

Impact: High barriers protect existing players, while low barriers increase competition, potentially driving down prices and margins.

Example: In the pharmaceutical industry, high R&D costs and strict regulations deter new entrants, reducing the threat.

Bargaining Power of Suppliers:

Description: This force assesses the influence suppliers have over the industry, based on their number, uniqueness of offerings, and switching costs for buyers.

Impact: Powerful suppliers can increase prices or reduce quality, squeezing buyer profitability.

Example: In the automotive industry, a limited number of specialized steel suppliers may have high bargaining power, impacting car manufacturers' costs.

Bargaining Power of Buyers:

Description: This force evaluates the influence buyers (customers) have on the industry, determined by their number, purchase volume, and ability to switch to alternatives.

Impact: Strong buyer power can force price reductions or demand higher quality, reducing profitability.

Example: In retail, large buyers like supermarkets can negotiate lower prices from suppliers due to their high purchase volumes.

Threat of Substitute Products or Services:

Description: This force analyzes the likelihood of customers switching to alternative products or services that meet the same need, based on price, performance, or availability.

Impact: A high threat of substitutes limits pricing power and profitability.

Example: In the beverage industry, the rise of plant-based milk (e.g., almond milk) poses a substitute threat to traditional dairy milk.

Competitive Rivalry within the Industry:

Description: This force examines the intensity of competition among existing firms, influenced by the number of competitors, market growth, and product differentiation.

Impact: High rivalry leads to price wars, increased marketing costs, or innovation pressures, reducing profitability.

Example: In the smartphone industry, intense rivalry between Apple and Samsung drives innovation but also squeezes margins through competitive pricing.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly references Porter's Five Forces as a tool for 'analyzing the competitive environment' to inform procurement and contract strategies. It is presented in the context of market analysis, helping organizations understand external pressures that impact supplier relationships, pricing, and financial outcomes. The guide emphasizes its relevance in strategic sourcing (as in Question 11) and risk management, ensuring buyers can negotiate better contracts and achieve value for money.

Detailed Explanation of Each Force:

Threat of New Entrants:

The guide notes that 'barriers to entry influence market dynamics.' For procurement, a low threat (e.g., due to high entry costs) means fewer suppliers, potentially increasing supplier power and costs. A buyer might use this insight to secure long-term contracts with existing suppliers to lock in favorable terms.

Bargaining Power of Suppliers:

Chapter 2 highlights that 'supplier power affects cost structures.' In L5M4, this is critical for financial management---high supplier power (e.g., few suppliers of a rare material) can inflate costs, requiring buyers to diversify their supply base or negotiate harder.

Bargaining Power of Buyers:

The guide explains that 'buyer power impacts pricing and margins.' For a manufacturer like XYZ Ltd (Question 7), strong buyer power from large clients might force them to source cheaper raw materials, affecting supplier selection.

Threat of Substitute Products or Services:

L5M4's risk management section notes that 'substitutes can disrupt supply chains.' A high threat (e.g., synthetic alternatives to natural materials) might push a buyer to collaborate with suppliers on innovation to stay competitive.

Competitive Rivalry within the Industry:

The guide states that 'rivalry drives market behavior.' High competition might lead to price wars, prompting buyers to seek cost efficiencies through strategic sourcing or supplier development (Questions 3 and 11).

Application in Contract Management:

Porter's Five Forces helps buyers assess the marketplace before entering contracts. For example, if supplier power is high (few suppliers), a buyer might negotiate longer-term contracts to secure supply. If rivalry is intense, they might prioritize suppliers offering innovation to differentiate their products.

Financially, understanding these forces ensures cost control---e.g., mitigating supplier power reduces cost inflation, aligning with L5M4's focus on value for money.

Practical Example for XYZ Ltd (Question 7):

Threat of New Entrants: Low, due to high setup costs for raw material production, giving XYZ Ltd fewer supplier options.

Supplier Power: High, if raw materials are scarce, requiring XYZ Ltd to build strong supplier relationships.

Buyer Power: Moderate, as XYZ Ltd's clients may have alternatives, pushing for competitive pricing.

Substitutes: Low, if raw materials are specialized, but XYZ Ltd should monitor emerging alternatives.

Rivalry: High, in manufacturing, so XYZ Ltd must source efficiently to maintain margins.

This analysis informs XYZ Ltd's supplier selection and contract terms, ensuring financial and operational resilience.

Broader Implications:

The guide advises using Porter's Five Forces alongside other tools (e.g., SWOT analysis) for a comprehensive market view. It also stresses that these forces are dynamic---e.g., new regulations might lower entry barriers, increasing competition over time.

In financial management, the model helps buyers anticipate cost pressures (e.g., from supplier power) and negotiate contracts that mitigate risks, ensuring long-term profitability.

CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Market Analysis and Competitive Environment.

Additional Reference: Chapter 4: Financial Management in Contracts, Section on Risk Management and Cost Control.

SIMULATION

What is strategic sourcing (10 marks) and what factors can influence this? (15 marks)

Answer : A

Part 1: What is Strategic Sourcing? (10 marks)

Strategic sourcing is a systematic and proactive approach to procurement that focuses on aligning purchasing decisions with an organization's long-term goals to maximize value, reduce costs, and mitigate risks. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, strategic sourcing goes beyond transactional buying to build supplier relationships and optimize the supply chain for financial and operational efficiency. Below is a step-by-step explanation:

Definition:

Strategic sourcing involves analyzing an organization's spending, identifying sourcing opportunities, selecting suppliers, and managing relationships to achieve strategic objectives.

It emphasizes value creation over simply minimizing costs.

Purpose:

Aims to ensure supply chain reliability, improve quality, and deliver financial benefits like cost savings or ROI.

Example: A company uses strategic sourcing to consolidate suppliers, reducing procurement costs by 15%.

Part 2: What Factors Can Influence Strategic Sourcing? (15 marks)

Several internal and external factors can impact the strategic sourcing process, affecting how an organization approaches supplier selection and contract management. Below are five key factors:

Market Conditions:

Economic trends, such as inflation or supply shortages, influence supplier pricing and availability.

Example: A rise in raw material costs may force a shift to alternative suppliers.

Organizational Goals and Strategy:

The company's priorities (e.g., sustainability, cost leadership) shape sourcing decisions.

Example: A focus on green initiatives may prioritize suppliers with eco-friendly practices.

Supplier Capabilities and Performance:

The supplier's ability to meet quality, delivery, and innovation requirements affects selection.

Example: A supplier with a poor track record for on-time delivery may be excluded.

Regulatory and Compliance Requirements:

Legal or industry standards (e.g., safety, environmental regulations) dictate sourcing choices.

Example: Sourcing must comply with EU REACH regulations for chemical suppliers.

Technology and Innovation:

Advances in technology (e.g., automation, data analytics) can change sourcing strategies by enabling better supplier evaluation or collaboration.

Example: Using AI to analyze supplier performance data for better decision-making.

Exact Extract Explanation:

Part 1: What is Strategic Sourcing?

The CIPS L5M4 Advanced Contract and Financial Management study guide defines strategic sourcing as 'a structured process to optimize an organization's supply base and improve the overall value proposition.' It is positioned as a key procurement strategy that integrates financial management principles, such as cost optimization and risk mitigation, with long-term business objectives. The guide emphasizes that strategic sourcing is not just about cost reduction but about 'delivering sustainable value' through supplier partnerships.

Detailed Explanation:

The guide outlines that strategic sourcing involves steps like spend analysis, market research, supplier evaluation, and contract negotiation. For example, a company might analyze its spending on raw materials, identify over-reliance on a single supplier, and strategically diversify to reduce risk.

It aligns with L5M4's focus on value for money by ensuring procurement decisions support broader goals, such as quality improvement or innovation. Strategic sourcing also fosters collaboration, as seen in practices like Early Supplier Involvement (Question 8).

Part 2: Factors Influencing Strategic Sourcing

The study guide discusses various influences on sourcing strategies, particularly in the context of supplier selection and contract management, emphasizing the need to adapt to internal and external dynamics.

Factors Explained:

Market Conditions:

The guide highlights that 'external market forces' like commodity price volatility or supply chain disruptions (e.g., post-COVID shortages) impact sourcing. A buyer might need to source locally if global supply chains are unstable, affecting cost and lead times.

Organizational Goals and Strategy:

Chapter 2 notes that sourcing must 'align with corporate objectives.' For instance, if a company prioritizes sustainability (a strategic goal), it may source from suppliers with low carbon footprints, even if they're costlier.

Supplier Capabilities and Performance:

The guide stresses evaluating 'supplier suitability' based on quality, reliability, and innovation capacity (as in Question 2). A supplier unable to scale production might be unsuitable for a growing business.

Regulatory and Compliance Requirements:

L5M4's risk management section underscores the need to comply with 'legal and regulatory frameworks.' For example, sourcing electronics components must meet RoHS standards, limiting supplier options.

Technology and Innovation:

The guide recognizes that 'technological advancements' enable better sourcing decisions. Tools like e-procurement platforms or data analytics (e.g., for spend analysis) help identify cost-saving opportunities or high-performing suppliers.

Practical Application:

For XYZ Ltd (Question 7), strategic sourcing might involve selecting a raw material supplier based on cost, quality, and sustainability. Market conditions (e.g., steel price hikes) might push them to local suppliers, while a strategic goal of reducing emissions influences them to choose a supplier with green certifications. Supplier performance (e.g., 98% on-time delivery), compliance with safety regulations, and the use of tech for supplier evaluation would further shape their approach.

Broader Implications:

The guide advises that these factors are interconnected---e.g., market conditions might force a reassessment of organizational goals. A balanced sourcing strategy considers all factors to mitigate risks and maximize value, aligning with L5M4's financial and operational focus.

Regular reviews of these factors ensure sourcing remains adaptive, such as shifting suppliers if new regulations emerge or technology improves.

CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Strategic Procurement and Sourcing.

Additional Reference: Chapter 4: Financial Management in Contracts, Section on Risk Management and Value Optimization.

SIMULATION

John is looking at the potential of three different projects and is considering the Return on Investment. What is meant by this, and what are the benefits and disadvantages of using this method? Which option should he choose? (25 marks)

Answer : A

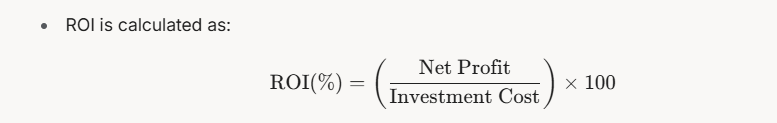

Part 1: What is meant by Return on Investment (ROI)? (8 marks)

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessing the financial viability of projects or contracts, ensuring they deliver value for money. Below is a step-by-step explanation:

Definition:

Net Profit = Total Returns -- Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing 100k that generates 120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4's emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1.

Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

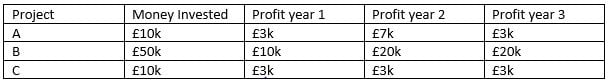

Using the data provided for the three projects, let's calculate the ROI for each to determine the best option for John. The table is as follows:

Step 1: Calculate Total Profit for Each Project:

Project A: 3k (Year 1) + 3k (Year 2) + 3k (Year 3) = 9k

Project B: 3k (Year 1) + 3k (Year 2) + 3k (Year 3) = 9k

Project C: 3k (Year 1) + 3k (Year 2) + 3k (Year 3) = 9k

Step 2: Calculate Net Profit (Total Profit -- Investment):

Project A: 9k -- 10k = -1k (a loss)

Project B: 9k -- 50k = -41k (a loss)

Project C: 9k -- 10k = -1k (a loss)

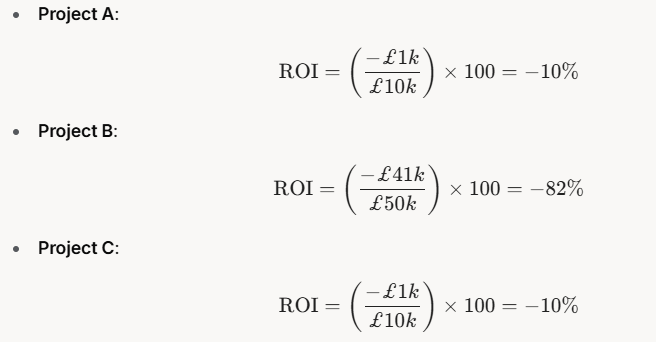

Step 3: Calculate ROI for Each Project:

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROI

All projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose either Project A or Project C over Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let's recommend Project A.

Recommendation: John should choose Project A (or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss.

Exact Extract Explanation:

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as 'a measure of the gain or loss generated on an investment relative to the amount invested,' typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing 'value for money,' a core principle of L5M4, especially when selecting projects or suppliers.

Detailed Explanation:

The guide explains that ROI is widely used because it provides a 'clear financial snapshot' of investment performance. In John's case, ROI helps compare the profitability of three projects.

It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI's role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations.

Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI's 'ease of calculation' makes it accessible for quick assessments, ideal for John's scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI's alignment with 'maximizing returns,' ensuring investments like John's projects deliver financial value.

Comparability:

ROI's percentage format allows 'cross-project comparisons,' per the guide, enabling John to evaluate projects with different investment levels.

Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI 'does not consider the timing of cash flows,' a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs.

Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss 'strategic benefits' like quality or innovation, which might apply to John's projects.

Potential for Misleading Results:

The guide cautions that ROI can be 'distorted' if costs or profits are misreported, a risk John should consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide's focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to 'rank investment options' but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide's emphasis on minimizing financial loss in poor-performing investments supports choosing A or C, as they have the least negative impact.

CIPS L5M4 Study Guide, Chapter 4: Financial Management in Contracts, Section on Financial Metrics and Investment Appraisal.

Additional Reference: Chapter 2: Performance Management in Contracts, Section on Decision-Making Tools.

SIMULATION

Describe what is meant by 'Supply Chain Integration' (8 marks). How would a buyer go about implementing this approach and what benefits could be gained from it? (17 marks).

Answer : A

Part 1: Describe what is meant by 'Supply Chain Integration' (8 marks)

Supply Chain Integration (SCI) refers to the seamless coordination and alignment of processes, information, and resources across all parties in a supply chain---suppliers, manufacturers, distributors, and buyers---to achieve a unified, efficient system. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, SCI emphasizes collaboration to optimize performance and deliver value. Below is a step-by-step explanation:

Definition:

SCI involves linking supply chain partners to work as a cohesive unit, sharing goals, data, and strategies.

It spans upstream (suppliers) and downstream (customers) activities.

Purpose:

Aims to eliminate silos, reduce inefficiencies, and enhance responsiveness to market demands.

Example: A buyer and supplier share real-time inventory data to prevent stockouts.

Part 2: How would a buyer go about implementing this approach and what benefits could be gained from it? (17 marks)

Implementation Steps:

Establish Collaborative Relationships:

Build trust and partnerships with suppliers through regular communication and joint planning.

Example: Set up quarterly strategy meetings with key suppliers.

Implement Information Sharing Systems:

Use technology (e.g., ERP systems, cloud platforms) to share real-time data on demand, inventory, and forecasts.

Example: Integrate a supplier's system with the buyer's to track orders live.

Align Objectives and KPIs:

Agree on shared goals and performance metrics (e.g., delivery speed, cost reduction) to ensure mutual accountability.

Example: Both parties target a 95% on-time delivery rate.

Streamline Processes:

Redesign workflows (e.g., joint procurement or production planning) to eliminate redundancies.

Example: Co-develop a just-in-time delivery schedule.

Benefits:

Improved Efficiency:

Streamlined operations reduce waste and lead times.

Example: Cutting order processing time from 5 days to 2 days.

Cost Savings:

Better coordination lowers inventory holding costs and optimizes resource use.

Example: Reducing excess stock by 20% through shared forecasting.

Enhanced Responsiveness:

Real-time data enables quick adaptation to demand changes.

Example: Adjusting supply within 24 hours of a sales spike.

Stronger Relationships:

Collaboration fosters trust and long-term supplier commitment.

Example: A supplier prioritizes the buyer during shortages.

Exact Extract Explanation:

Part 1: What is Supply Chain Integration?

The CIPS L5M4 Advanced Contract and Financial Management study guide does not dedicate a specific section to SCI but embeds it within discussions on supplier relationships and performance optimization. It describes SCI as 'the alignment of supply chain activities to achieve a seamless flow of goods, services, and information.' The guide positions it as a strategic approach to enhance contract outcomes by breaking down barriers between supply chain partners, aligning with its focus on value delivery and financial efficiency.

Detailed Explanation:

SCI integrates processes like procurement, production, and logistics across organizations. The guide notes that 'effective supply chains require coordination beyond contractual obligations,' emphasizing shared goals over transactional interactions.

For example, a manufacturer (buyer) integrating with a raw material supplier ensures materials arrive just as production ramps up, avoiding delays or overstocking. This reflects L5M4's emphasis on operational and financial synergy.

Part 2: Implementation and Benefits

The study guide highlights SCI as a means to 'maximize efficiency and value,' linking it to contract management and financial performance. It provides implicit guidance on implementation and benefits through its focus on collaboration and performance metrics.

Implementation Steps:

Establish Collaborative Relationships:

Chapter 2 stresses 'partnership approaches' to improve supplier performance. This starts with trust-building activities like joint workshops, aligning with SCI's collaborative ethos.

Implement Information Sharing Systems:

The guide advocates 'technology-enabled transparency' (e.g., shared IT platforms) to enhance visibility, a cornerstone of SCI. This reduces guesswork and aligns supply with demand.

Align Objectives and KPIs:

L5M4 emphasizes 'mutually agreed performance measures' (e.g., KPIs like delivery accuracy). SCI requires this alignment to ensure all parties work toward common outcomes.

Streamline Processes:

The guide suggests 'process optimization' through collaboration, such as synchronized planning, to eliminate inefficiencies---a practical step in SCI.

Benefits:

Improved Efficiency:

The guide links integrated processes to 'reduced cycle times,' a direct outcome of SCI. For instance, shared data cuts delays, aligning with operational goals.

Cost Savings:

Chapter 4 highlights 'minimizing waste' as a financial management priority. SCI reduces excess inventory and transport costs, delivering tangible savings.

Enhanced Responsiveness:

The guide notes that 'agile supply chains adapt to market shifts,' a benefit of SCI's real-time coordination. This supports competitiveness, a strategic L5M4 focus.

Stronger Relationships:

Collaboration 'builds resilience and trust,' per the guide. SCI fosters partnerships, ensuring suppliers prioritize the buyer's needs, enhancing contract stability.

Practical Application:

For XYZ Ltd (from Question 7), SCI might involve integrating a raw material supplier into their production planning. Implementation includes an ERP link for inventory data, aligned KPIs (e.g., 98% delivery reliability), and joint scheduling. Benefits could include a 15% cost reduction, 3-day faster lead times, and a supplier committed to priority service during peak demand.

The guide advises balancing integration costs (e.g., IT investment) with long-term gains, a key financial consideration in L5M4.

CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Supplier Relationships and Collaboration.

Additional Reference: Chapter 4: Financial Management in Contracts, Section on Efficiency and Cost Management.

SIMULATION

Describe what is meant by Early Supplier Involvement (10 marks) and the benefits and disadvantages to this approach (15 marks).

Answer : A

Part 1: Describe what is meant by Early Supplier Involvement (10 marks)

Early Supplier Involvement (ESI) refers to the practice of engaging suppliers at the initial stages of a project or product development process, rather than after specifications are finalized. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ESI is a collaborative strategy that integrates supplier expertise into planning, design, or procurement phases to optimize outcomes. Below is a step-by-step explanation:

Definition:

ESI involves bringing suppliers into the process early---often during concept development, design, or pre-contract stages---to leverage their knowledge and capabilities.

It shifts from a traditional sequential approach to a concurrent, partnership-based model.

Purpose:

Aims to improve product design, reduce costs, enhance quality, and shorten time-to-market by incorporating supplier insights upfront.

Example: A supplier of raw materials advises on material selection during product design to ensure manufacturability.

Part 2: Benefits and Disadvantages to this Approach (15 marks)

Benefits:

Improved Design and Innovation:

Suppliers contribute technical expertise, leading to better product specifications or innovative solutions.

Example: A supplier suggests a lighter material, reducing production costs by 10%.

Cost Reduction:

Early input helps identify cost-saving opportunities (e.g., alternative materials) before designs are locked in.

Example: Avoiding expensive rework by aligning design with supplier capabilities.

Faster Time-to-Market:

Concurrent planning reduces delays by addressing potential issues (e.g., supply constraints) early.

Example: A supplier prepares production capacity during design, cutting lead time by weeks.

Disadvantages:

Increased Coordination Effort:

Requires more upfront collaboration, which can strain resources or complicate decision-making.

Example: Multiple stakeholder meetings slow initial progress.

Risk of Dependency:

Relying on a single supplier early may limit flexibility if they underperform or exit.

Example: A supplier's failure to deliver could derail the entire project.

Confidentiality Risks:

Sharing sensitive design or strategy details early increases the chance of leaks to competitors.

Example: A supplier inadvertently shares proprietary specs with a rival.

Exact Extract Explanation:

Part 1: What is Early Supplier Involvement?

The CIPS L5M4 Advanced Contract and Financial Management study guide discusses ESI within the context of supplier collaboration and performance optimization, particularly in complex contracts or product development. While not defined in a standalone section, it is referenced as a strategy to 'engage suppliers early in the process to maximize value and efficiency.' The guide positions ESI as part of a shift toward partnership models, aligning with its focus on achieving financial and operational benefits through strategic supplier relationships.

Detailed Explanation:

ESI contrasts with traditional procurement, where suppliers are selected post-design. The guide notes that 'involving suppliers at the specification stage' leverages their expertise to refine requirements, ensuring feasibility and cost-effectiveness.

For instance, in manufacturing, a supplier might suggest a more readily available alloy during design, avoiding supply chain delays. This aligns with L5M4's emphasis on proactive risk management and value creation.

The approach is often linked to techniques like Simultaneous Engineering (covered elsewhere in the guide), where overlapping tasks enhance efficiency.

Part 2: Benefits and Disadvantages

The study guide highlights ESI's role in delivering 'strategic value' while cautioning about its challenges, tying it to financial management and contract performance principles.

Benefits:

Improved Design and Innovation:

The guide suggests that 'supplier input can enhance product quality and innovation,' reducing downstream issues. This supports L5M4's focus on long-term value over short-term savings.

Cost Reduction:

Chapter 4 emphasizes 'minimizing total cost of ownership' through early collaboration. ESI avoids costly redesigns by aligning specifications with supplier capabilities, a key financial management goal.

Faster Time-to-Market:

The guide links ESI to 'efficiency gains,' noting that concurrent processes shorten development cycles. This reduces holding costs and accelerates revenue generation, aligning with financial efficiency.

Disadvantages:

Increased Coordination Effort:

The guide warns that 'collaborative approaches require investment in time and resources.' For ESI, this means managing complex early-stage interactions, potentially straining procurement teams.

Risk of Dependency:

L5M4's risk management section highlights the danger of over-reliance on key suppliers. ESI ties the buyer to a supplier early, risking disruption if they fail to deliver.

Confidentiality Risks:

The guide notes that sharing information with suppliers 'increases exposure to intellectual property risks.' In ESI, sensitive data shared prematurely could compromise competitive advantage.

Practical Application:

For a manufacturer like XYZ Ltd (from Question 7), ESI might involve a raw material supplier in designing a component, ensuring it's cost-effective and producible. Benefits include a 15% cost saving and a 3-week faster launch, but disadvantages might include extra planning meetings and the risk of locking into a single supplier.

The guide advises balancing ESI with risk mitigation strategies (e.g., confidentiality agreements, multiple supplier options) to maximize its value.

CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Supplier Collaboration and Strategic Relationships.

Additional Reference: Chapter 4: Financial Management in Contracts, Section on Cost Optimization and Risk Management.

SIMULATION

XYZ Ltd is a manufacturing organisation who is looking to appoint a new supplier of raw materials. Describe 5 selection criteria they could use to find the best supplier. (25 marks)

Answer : A

Selecting the right supplier is a critical decision for XYZ Ltd, a manufacturing organization, to ensure the supply of raw materials meets operational, financial, and strategic needs. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, supplier selection criteria should align with achieving value for money, operational efficiency, and long-term partnership potential. Below are five detailed selection criteria XYZ Ltd could use, explained step-by-step:

Cost Competitiveness:

Description: The supplier's pricing structure, including unit costs, discounts, and total cost of ownership (e.g., delivery or maintenance costs).

Why Use It: Ensures financial efficiency and budget adherence, a key focus in L5M4.

Example: A supplier offering raw materials at $10 per unit with free delivery might be preferred over one at $9 per unit with high shipping costs.

Quality of Raw Materials:

Description: The consistency, reliability, and compliance of materials with specified standards (e.g., ISO certifications, defect rates).

Why Use It: High-quality materials reduce production defects and rework costs, supporting operational and financial goals.

Example: A supplier with a defect rate below 1% and certified quality processes.

Delivery Reliability:

Description: The supplier's ability to deliver materials on time and in full, measured by past performance or promised lead times.

Why Use It: Ensures manufacturing schedules are met, avoiding costly downtime.

Example: A supplier guaranteeing 98% on-time delivery within 5 days.

Financial Stability:

Description: The supplier's economic health, assessed through credit ratings, profitability, or debt levels.

Why Use It: Reduces the risk of supply disruptions due to supplier insolvency, aligning with L5M4's risk management focus.

Example: A supplier with a strong balance sheet and no recent bankruptcies.

Capacity and Scalability:

Description: The supplier's ability to meet current demand and scale production if XYZ Ltd's needs grow.

Why Use It: Ensures long-term supply reliability and supports future growth, a strategic consideration in contract management.

Example: A supplier with spare production capacity to handle a 20% volume increase.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes supplier selection as a foundational step in contract management, directly impacting financial performance and operational success. The guide advises using 'robust criteria' to evaluate suppliers, ensuring they deliver value for money and mitigate risks. While it does not list these exact five criteria verbatim, they are derived from its principles on supplier appraisal and performance management.

Criterion 1: Cost Competitiveness:

The guide stresses 'total cost of ownership' (TCO) over just purchase price, a key financial management concept in L5M4. This includes direct costs (e.g., price per unit) and indirect costs (e.g., transport, storage). For XYZ Ltd, selecting a supplier with competitive TCO ensures budget efficiency.

Application: A supplier might offer lower initial costs but higher long-term expenses (e.g., frequent delays), making TCO a critical metric.

Criterion 2: Quality of Raw Materials:

Chapter 2 highlights quality as a 'non-negotiable performance measure' in supplier evaluation. Poor-quality materials increase rework costs and affect product reliability, undermining financial goals.

Practical Example: XYZ Ltd might require suppliers to provide test samples or quality certifications, ensuring materials meet manufacturing specs.

Criterion 3: Delivery Reliability:

The guide links timely delivery to operational efficiency, noting that 'supply chain disruptions can have significant cost implications.' For a manufacturer like XYZ Ltd, late deliveries could halt production lines, incurring penalties or lost sales.

Measurement: Past performance data (e.g., 95% on-time delivery) or contractual commitments to lead times are recommended evaluation tools.

Criterion 4: Financial Stability:

L5M4's risk management section advises assessing a supplier's 'financial health' to avoid dependency on unstable partners. A financially shaky supplier risks failing mid-contract, disrupting XYZ Ltd's supply chain.

Assessment: Tools like Dun & Bradstreet reports or financial statements can verify stability, ensuring long-term reliability.

Criterion 5: Capacity and Scalability:

The guide emphasizes 'future-proofing' supply chains by selecting suppliers capable of meeting evolving demands. For XYZ Ltd, a supplier's ability to scale production supports growth without the cost of switching vendors.

Evaluation: Site visits or capacity audits can confirm a supplier's ability to handle current and future volumes (e.g., 10,000 units monthly now, 12,000 next year).

Broader Implications:

These criteria should be weighted based on XYZ Ltd's priorities (e.g., 30% cost, 25% quality) and combined into a supplier scorecard, a method endorsed by the guide for structured decision-making.

The guide also suggests involving cross-functional teams (e.g., procurement, production) to define criteria, ensuring alignment with manufacturing needs.

Financially, selecting the right supplier minimizes risks like stockouts or quality issues, which could inflate costs---aligning with L5M4's focus on cost control and value delivery.

Practical Application for XYZ Ltd:

Cost: Compare supplier quotes and TCO projections.

Quality: Request material samples and compliance certificates.

Delivery: Review historical delivery records or negotiate firm timelines.

Financial Stability: Analyze supplier financials via third-party reports.

Capacity: Assess production facilities and discuss scalability plans.

This multi-faceted approach ensures XYZ Ltd appoints a supplier that balances cost, quality, and reliability, optimizing contract outcomes.

CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Supplier Appraisal and Selection.

Additional Reference: Chapter 4: Financial Management in Contracts, Section on Cost Management and Risk Mitigation.

SIMULATION

What is a 'Balanced Scorecard'? (15 marks). What would be the benefits of using one? (10 marks)

Answer : A

Part 1: What is a 'Balanced Scorecard'? (15 marks)

A Balanced Scorecard (BSC) is a strategic performance management tool that provides a framework for measuring and monitoring an organization's performance across multiple perspectives beyond just financial metrics. Introduced by Robert Kaplan and David Norton, it integrates financial and non-financial indicators to give a holistic view of organizational success. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, the BSC is relevant for evaluating contract performance and supplier relationships by aligning them with broader business objectives. Below is a step-by-step explanation:

Definition:

The BSC is a structured approach that tracks performance across four key perspectives: Financial, Customer, Internal Processes, and Learning & Growth.

It translates strategic goals into measurable objectives and KPIs.

Four Perspectives:

Financial Perspective: Focuses on financial outcomes (e.g., cost savings, profitability).

Customer Perspective: Measures customer satisfaction and service quality (e.g., delivery reliability).

Internal Process Perspective: Evaluates operational efficiency (e.g., process cycle time).

Learning & Growth Perspective: Assesses organizational capability and innovation (e.g., staff training levels).

Application in Contracts:

In contract management, the BSC links supplier performance to strategic goals, ensuring alignment with financial and operational targets.

Example: A supplier's on-time delivery (Customer) impacts cost efficiency (Financial) and requires process optimization (Internal Processes).

Part 2: What would be the benefits of using one? (10 marks)

The Balanced Scorecard offers several advantages, particularly in managing contracts and supplier performance. Below are the key benefits:

Holistic Performance View:

Combines financial and non-financial metrics for a comprehensive assessment.

Example: Tracks cost reductions alongside customer satisfaction improvements.

Improved Decision-Making:

Provides data-driven insights across multiple dimensions, aiding strategic choices.

Example: Identifies if poor supplier training (Learning & Growth) causes delays (Internal Processes).

Alignment with Strategy:

Ensures contract activities support broader organizational goals.

Example: Links supplier innovation to long-term competitiveness.

Enhanced Communication:

Offers a clear framework to share performance expectations with suppliers and stakeholders.

Example: A BSC report highlights areas needing improvement, fostering collaboration.

Exact Extract Explanation:

Part 1: What is a 'Balanced Scorecard'?

The CIPS L5M4 Advanced Contract and Financial Management study guide does not explicitly define the Balanced Scorecard in a dedicated section but references it within the context of performance measurement tools in contract and supplier management. It aligns with the guide's emphasis on 'measuring performance beyond financial outcomes' to ensure value for money and strategic success. The BSC is presented as a method to 'balance short-term financial goals with long-term capability development,' making it highly relevant to contract management.

Detailed Explanation:

The guide explains that traditional financial metrics alone (e.g., budget adherence) are insufficient for assessing contract success. The BSC addresses this by incorporating the four perspectives:

Financial: Ensures contracts deliver cost efficiencies or ROI, a core L5M4 focus. Example KPI: 'Cost per unit reduced by 5%.'

Customer: Links supplier performance to end-user satisfaction, such as '95% on-time delivery.'

Internal Processes: Monitors operational effectiveness, like 'reduced procurement cycle time by 10%.'

Learning & Growth: Focuses on capability building, such as 'supplier staff trained in new technology.'

In practice, a BSC for a supplier might include KPIs like profit margin (Financial), complaint resolution time (Customer), defect rate (Internal Processes), and innovation proposals (Learning & Growth).

The guide stresses that the BSC is customizable, allowing organizations to tailor it to specific contract goals, such as sustainability or quality improvement.

Part 2: Benefits of Using a Balanced Scorecard

The study guide highlights the BSC's value in providing 'a structured approach to performance management' that supports financial and strategic objectives. Its benefits are implicitly tied to L5M4's focus on achieving value for money and managing supplier relationships effectively.

Holistic Performance View:

The guide notes that relying solely on financial data can overlook critical issues like quality or supplier capability. The BSC's multi-perspective approach ensures a rounded evaluation, e.g., identifying if cost savings compromise service levels.

Improved Decision-Making:

By presenting performance data across all four areas, the BSC helps managers prioritize actions. The guide suggests that 'performance tools should inform corrective measures,' and the BSC excels here by linking cause (e.g., poor training) to effect (e.g., delays).

Alignment with Strategy:

Chapter 2 emphasizes aligning supplier performance with organizational goals. The BSC achieves this by translating high-level objectives (e.g., 'improve market share') into actionable supplier metrics (e.g., 'faster product development').

Enhanced Communication:

The guide advocates clear performance reporting to stakeholders. The BSC's visual framework (e.g., a dashboard) simplifies discussions with suppliers, ensuring mutual understanding of expectations and progress.

Practical Example:

A company using a BSC might evaluate a supplier contract with:

Financial: 10% cost reduction achieved.

Customer: 98% customer satisfaction score.

Internal Processes: 2-day order processing time.

Learning & Growth: 80% of supplier staff certified in quality standards.

This holistic view ensures the contract delivers both immediate financial benefits and sustainable value, a key L5M4 principle.

CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Performance Measurement Tools.

Additional Reference: Chapter 4: Financial Management in Contracts, Section on Value for Money and Strategic Alignment.