CIMA P2 Advanced Management Accounting CIMAPRO19-P02-1 Exam Practice Test

Which of the following is a key objective when agreeing a basis for setting transfer prices?

Answer : A

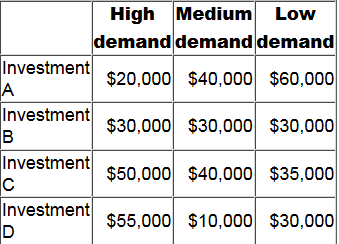

A company is considering four mutually exclusive projects. There are three possible future demand conditions but the company has no idea of the probability of each of these demand conditions occurring. The forecast net present values (NPVs) of each of the four projects, under each of the three possible future demand conditions, are as follows.

Using the maximax criterion, which investment should be selected?

Answer : A

K Supermarket spends $80,000 per year on checking and processing receipts of inventory. Annual warehouse costs are a further $70,000 per year. These costs are currently treated as fixed overheads in the company's costing system.

As an experiment, the company is preparing a direct profitability analysis of a small range of products, including fresh grapes.

K Supermarket receives a total of 3,600 deliveries every year. 20% of these deliveries are of perishable goods such as grapes. It takes twice as long to process a delivery of perishable goods compared to a normal delivery because perishable goods have to be checked more carefully.

Half of the warehouse costs are for the chilled store that is used to store perishable goods. At any time, the chilled store has 800 kilos of perishable goods in stock.

K Supermarket receives 150 deliveries of grapes every year. Each delivery is for 100 kilos of grapes. The grapes spend an average of two days in the chilled store before they are sold.

Calculate the total cost per kilo of checking, processing and storing grapes that should be taken into account in determining the profitability of grapes.

Give your answer to the nearest whole cent.

See Below Explanation:

Answer : A

Which of the following is the ideal basis to use for a transfer price when there is a perfect external market?

Answer : B

An organization wants to increase the use value that customers place on one of its products - a laptop computer.

Which of the following actions, taken to increase the value to the customer, would increase the product's use value?

Select ALL that apply.

Answer : B, E

A division of a company transfers all its output to other divisions in the same company.

For this division, which of the following measures is NOT affected by the transfer price that the division uses?

Answer : C

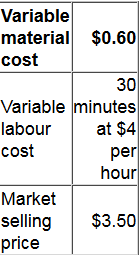

A company manufactures and sells a range of products. Relevant data for one unit of a particular product are as follows.

The company is using target costing to ensure that it achieves a contribution of 40% of the market selling price.

In order to achieve the target cost, by how much does the company need to reduce the variable cost per unit?

Answer : B