CIMA P1 Management Accounting CIMAPRO19-P01-1 Exam Questions

The labour requirement for a special contract is 250 skilled labour hours paid at $10 per hour and 750 semi-skilled labour hours paid at $8 per hour.

At present, skilled labour is fully utilised on other contracts which generate a $12 contribution per hour, after charging labour costs. Additional skilled labour is unavailable in the short term.

There is a surplus of 1,200 semi-skilled hours over the period of the contract but the firm has a policy of no redundancies.

The relevant cost of labour for the special contract is:

Answer : A

Your company want to know how many units they'd have to sell this season to break even. However, you have some reservations over whether or not breakeven analysis is suitable for the company.

Which of these assumptions over product range limit the accuracy of break even analysis? Select ALL that apply.

Answer : A, B

In a manufacturing company, breakeven occurs at which TWO of the following?

Answer : B, E

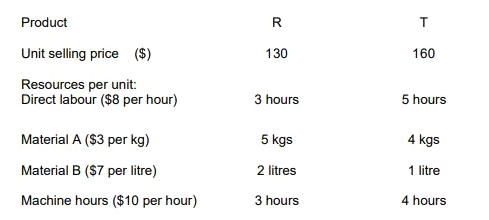

RT produces two products from different quantities of the same resources using a just-in-time (JIT) production system. The selling price and resource requirements of each of the products are shown below:

Market research shows that the maximum demand for products R and T during June 2010 is 500 units and 800 units respectively. This does not include an order that RT has agreed with a commercial customer for the supply of 250 units of R and 350 units of T at selling prices of $100 and $135 per unit respectively. Although the customer will accept part of the order, failure by RT to deliver the order in full by the end of June will cause RT to incur a $10,000 financial penalty. At a recent meeting of the purchasing and production managers to discuss the production plans of RT for June, the following resource restrictions for June were identified: Direct labour hours 7,500 hours

Material A 8,500 kgs

Material B 3,000 litres

Machine hours 7,500 hours

(Refer to previous 2 questions.)

You have now presented your optimum production plan to the purchasing and production managers of RT. During your presentation it became clear that the predicted resource restrictions were rather optimistic. In fact, the managers agreed that the availability of all of the resources could be as much as 10% lower than their original predictions.

Assuming that RT completes the order with the commercial customer, and using linear programming, show the optimum production plan for RT for June 2010 on the basis that the availability of all resources is 10% lower than originally predicted.

Answer : F

References:

Which of the following statements regarding marginal and absorption costing are true in the context of pricing decisions?

Select ALL that apply.

Answer : B, C, E

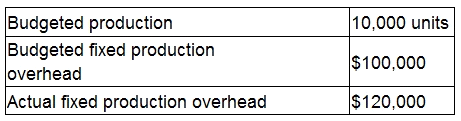

A company manufactures a single product. The company absorbs fixed production overhead using a pre-determined rate per unit.

The following data applies for month 7:

During month 7 fixed production overhead was over absorbed by $40,000.

What was the actual number of units produced during month 7?

Answer : A

The simplex method has been used to determine the optimum output of products P, Q, R and S with constraints on resources J, K and L.

In the final simplex tableau, the figure in the product R row and the column for slack variable K is 80.

Which of the following statements is correct?

Answer : B