CIMAPRA19-F03-1 F3 Financial Strategy Exam Practice Test

F Co. is a large private company, the founder holds 60% of the company's share capital and her 2 children each hold 20% of the share capital.

The company requires a large amount of long-term finance to pursue expansion opportunities, the finance is required within the next 3 months. The family has agreed that an Initial Public Offering (IPO) should not be pursued at this time, because it would take up to 12 months to arrange.

The existing shareholders are currently considering raising the required finance from an established Venture Capitalist in the form of debt and equity. The Venture Capitalist has agreed to provide the required finance provided it can earn a return on investment of 25% per year. In addition, the Venture Capitalist requires 60% of the equity capital, a directorship in the company and a veto on all expenditure of a capital or revenue nature above a specified limit.

From the perspective of the family, which of the following are advantages of raising the required finance from the Venture Capitalist?

Select all that apply.

Answer : A, C

Which THREE of the following statements are correct in respect of the issuance of debt securities.

Answer : C, D, E

A company is considering a divestment via either a management buyout (MBO) or sale to a private equity purchaser. Which of the following is an argument in favour of the MBO from the viewpoint of the original company?

Answer : A

Company A operates in country A and uses currency AS. It is looking to acquire Company B which operates in country B and uses currency B$. The following information is relevant:

The assistant accountant at Company A has prepared the following valuation of company B's equity, however there are some errors in his calculations.

Value of Company B's equity = 14.16 + 16.03 + 17.67 = AS47.86 million

Company B has BS5 million of debt finance.

Which of the following THREE statements are true?

Answer : B, C, D

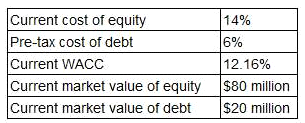

TTT pic is a listed company. The following information is relevant:

TTT pic's board is considering issuing new 6% irredeemable debt to re-purchase equity. This is expected to change TTT pic's debt to equity mix to 40: 60 by market value. The corporate tax rate is 20%.

What will be TTT pic's WACC following this change in capital structure?

Answer : D

Which of the following would be a reason for a company to adopt a low dividend pay-out policy?

Answer : D

The financial assistant of a geared company has prepared the following calculation of the company's equity value:

Useful information;

* Tax rate - 20%

* Cost of equity = 12%

* Weighted average cost of capital (WACC) 10%

" Debt finance of the company comprises a $6 million 7% undated bond trading at par Valuation workings.

Which of the following errors has been made by the financial assistant?

Answer : D