CIMAPRA19-F01-1 F1 Financial Reporting Exam Practice Test

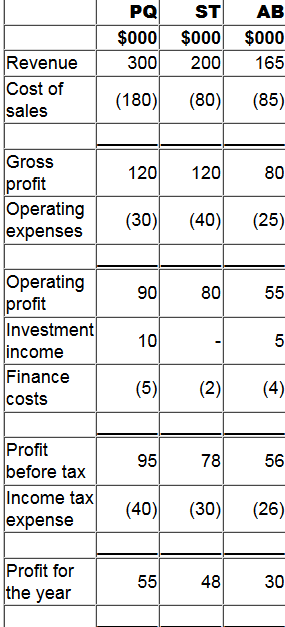

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

Calculate the amount that will be shown as the share of profit of associate in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0.

Answer : B

Which TWO of the following would improve a company's short term cash flow position?

Answer : A, D

In accordance with IFRS 3 Business Combinations, acquisition accounting of an investment in another entity within the consolidated statement of financial position means that the:

Answer : A

In accordance with IAS 16 Property, Plant and Equipment, in which of the following situations would subsequent expenditure on a non-current asset be capitalised?

Answer : A

LM is preparing its cash forecast for the next three months.

Which of the following items should be left out of its calculations?

Answer : C

Which of the following would be classified as a parent and subsidiary relationship in accordance with IFRS 10 Consolidated Financial Statements?

Answer : A

WX is considering an investment in ST.

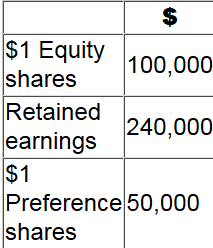

At 31 December 20X2 ST had the following balances in its statement of financial position:

Which of the following would cause ST to become an associate investment of WX?

Answer : B