CIMAPRA17-BA3-1 BA3 - Fundamentals of Financial Accounting Exam Practice Test

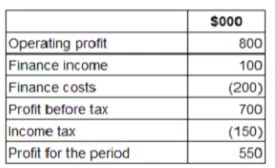

GG has the following statement of profit or loss extract for the year ended 31 December 20X3

What is the interest cover for GG for the year ended 31 December 20X3?

Answer : B

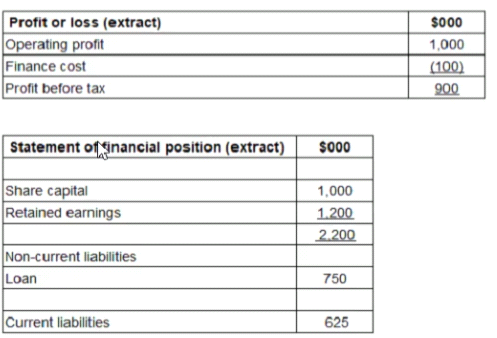

The following are extracts from CD's financial statements for the year to 31 December 20X2:

What is the return on capital employed percentage (ROCE) for CD for the year ended 31 December 20X2?

Answer : C

UVW is preparing its manufacturing account for the year ended 30 June 20X7 The following information is available:

What is UVWs prime cost for year ended 30 June 20X7?

Answer : A

In relation to accounting coding systems in the computerized records of an entity, which of the following is true?

Answer : A

IAS 2 Inventories does not permit the use of the last in. first out (LIFO) method of valuing inventory In a time of rising prices, which of the following is a reason for this?

Answer : B

Which one of the following would not be considered a purpose of segregation of duty?

Answer : A

Which one of the following would not contribute to the prevention and detection of fraud?

Answer : A