CIMAPRA17-BA2-1 BA2 - Fundamentals of Management Accounting Exam Practice Test

The wages of a machine operator who is paid a guaranteed minimum wage plus a bonus for each unit produced would be described as A.

Answer : B

Refer to the exhibit.

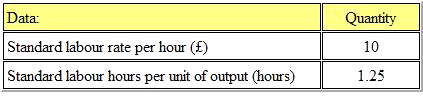

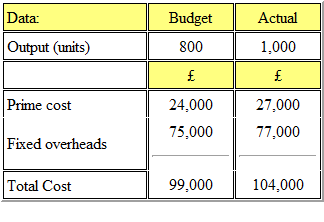

The following standard cost information relates to the production department of BE Ltd.

The actual data for the month of March was as follows:

What is the direct labour efficiency variance (to the nearest whole number)?

Answer : A

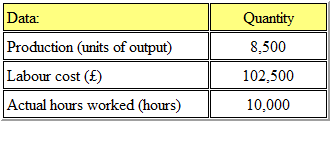

Refer to the exhibit.

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1,000 units. The details of the costs are shown below:

The total budget variance was:

Answer : A

Which of the following may result in a favourable material price variance? (Select ALL that apply.)

Answer : A, B, C

Which ONE of the following would be the LEAST effective performance indicator for a distribution manager who is responsible for controlling the cost of the transport fleet?

Answer : B

The management accountant has completed the appraisal of an investment in new office equipment.

It has now been discovered that the cost of capital used in the appraisal should have been higher.

What will be the effect on the calculated net present value (NPV) and the payback period?

Answer : C

Which of the following statements about CIMA's role in relation to its students is correct?

i. CIMA's professional conduct staff process complaints made against CIMA students

ii. Students are not governed by CIMA's code of ethics until they become registered CIMA members

iii. Students may consult CIMA about situations in their work place that appear to conflict with CIMA's code of ethics

iv. Once students have passed all of the CIMA exams they may use the designatory letters ACMA

Answer : C