APA FPC-Remote Fundamental Payroll Certification Exam Practice Test

On June 1st, the Payroll Department received an SUI rate change notice indicating a new rate effective January 1st of the current year. The system was not updated with the new rate until October 1st. SUI contribution recalculation will need to be done for:

Answer : D

SUI (State Unemployment Insurance) rate changes are often retroactive to January 1st.

Since the system was not updated until October, payroll must recalculate all affected quarters (1st, 2nd, and 3rd).

SUI Tax Compliance Guide (Payroll.org)

IRS Publication 15 (Employer's Tax Guide)

All of the following preventative measures would help protect personally identifiable information EXCEPT:

Answer : D

E-mail is NOT a secure method for protecting sensitive payroll and HR data.

Best practices include data encryption, access control, and employee training.

Data Security Standards (Payroll.org)

IRS Data Protection Guidelines

Which of the following situations does NOT reflect constructive receipt of wages?

Answer : C

Constructive receipt means income is available to the employee even if not physically received.

Option C is correct because when a paycheck is mailed, it is not immediately available, delaying constructive receipt.

IRS Publication 15 (Employer's Tax Guide)

Payroll Tax Compliance Guide (Payroll.org)

Under the FMLA, employers MUST maintain related leave records for how many years?

Answer : B

The Family and Medical Leave Act (FMLA) requires employers to keep FMLA-related records for at least 3 years.

These records include:

Employee leave requests

Employer responses

Payroll and benefits records

Medical certifications

The DOL may audit these records to ensure FMLA compliance.

FMLA Recordkeeping Requirements (DOL)

Payroll Record Retention Guidelines (Payroll.org)

Which organization should be contacted when placing a stop payment on a check?

Answer : C

ODFI (Originating Depository Financial Institution) is responsible for initiating payroll transactions, including stop payments.

RDFI (Receiving Depository Financial Institution) receives funds but does not control stop payments.

NACHA (National Automated Clearing House Association) sets ACH rules but does not process transactions.

FDIC (Federal Deposit Insurance Corporation) insures bank deposits but does not handle payment stops.

NACHA Operating Rules & Guidelines

Payroll Banking & ACH Processing Guide (Payroll.org)

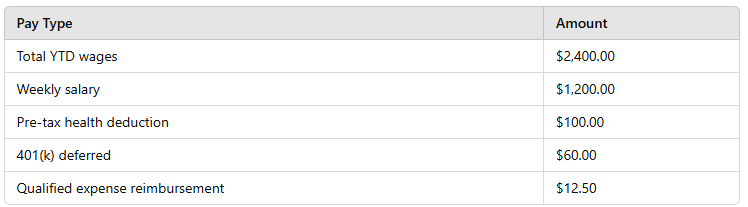

Using the following information, calculate the FUTA tax liability:

Answer : B

Step 1: Determine taxable wages

FUTA tax applies to the first $7,000 of an employee's wages annually.

Step 2: Calculate FUTA tax

FUTA rate: 0.6% (after state credit)

FUTA-taxable wages: $1,200.00

FUTA tax: $1,200 0.006 = $6.60

IRS Publication 15 (Employer's Tax Guide)

FUTA Tax Calculation Guide (Payroll.org)

The FLSA is enforced by which of the following entities?

Answer : A

The Fair Labor Standards Act (FLSA) is enforced by the Department of Labor (DOL) through its Wage and Hour Division (WHD).

ICE (Immigration and Customs Enforcement) handles immigration-related work issues, not wage enforcement.

IRS (Internal Revenue Service) enforces tax laws, not labor standards.

SSA (Social Security Administration) manages Social Security benefits, not wage laws.

FLSA Compliance and Enforcement (DOL)

Payroll Compliance Guidelines (Payroll.org)