AICPA CPA-Financial CPA Financial Accounting and Reporting CPA Exam Practice Test

On January 2, 1993, Quo, Inc. hired Reed to be its controller. During the year, Reed, working closely with Quo's president and outside accountants, made changes in accounting policies, corrected several errors dating from 1992 and before, and instituted new accounting policies.

Quo's 1993 financial statements will be presented in comparative form with its 1992 financial statements.

This question represents one of Quo's transactions. List A represents possible clarifications of these transactions as: a change in accounting principle, a change in accounting estimate, a correction of an error in previously presented financial statements, or neither an accounting change nor an accounting error.

Item to Be Answered

During 1993, Quo determined that an insurance premium paid and entirely expensed in 1992 was for the period January 1, 1992, through January 1, 1994.

List A (Select one)

Answer : C

Choice 'c' is correct. Expensing insurance premiums when paid (rather than allocating them to the periods benefited) is a correction of an error in previously presented financial statements.

Chester Corp. was a development stage enterprise from its inception on September 1, 1987 to December 31, 1988. The following information was taken from Chester's accounting records for the above period:

For the period September 1, 1987 to December 31, 1988, what amount should Chester report as net loss?

Answer : D

Choice 'd' is correct. $450,000 net loss for the period Sept. 1, 1987 to DeC. 31, 1988.

Rule: 'Development stage enterprises' present their FS in accordance with GAAP and make additional disclosures such as: cumulative net losses, cumulative deficit, cumulative sales and expenses.

Grum Corp., a publicly-owned corporation, is subject to the requirements for segment reporting. In its income statement for the year ended December 31, 1991, Grum reported revenues of $50,000,000, operating expenses of $47,000,000, and net income of $3,000,000. Operating expenses include payroll costs of $ 15,000,000. Grum's combined identifiable assets of all industry segments at December 31, 1991, were $40,000,000.

Cott Co.'s four business segments have revenues and identifiable assets expressed as percentages of Cott's total revenues and total assets as follows:

Which of these business segments are deemed to be reportable segments?

Answer : D

Rule: A segment must be at least 10% of:

1. Combined revenues (whether intersegment or unaffiliated customers), or

2. Operating income (of all segments not having an operating loss), or

3. Identifiable assets.

Choice 'd' is correct. Ebon, Fair, Gel, and Hak, since all four companies meet at least one of the criteria.

An inventory loss from a market price decline occurred in the first quarter, and the decline was not expected to reverse during the fiscal year. However, in the third quarter the inventory's market price recovery exceeded the market decline that occurred in the first quarter. For interim financial reporting, the dollar amount of net inventory should:

Answer : C

Choice 'a' is correct. Market price declines should be recognized in the interim period in which decline is judged permanent and later, if they 'turn around,' are recognized as gains in subsequent periods only to the extent of previously reported losses.

Choice 'b' is incorrect. Recovery should not cause an increase in inventory value above original cost.

Choice 'c' is incorrect. The recovery should be recognized to the extent of the first quarter write down.

Choice 'd' is incorrect.

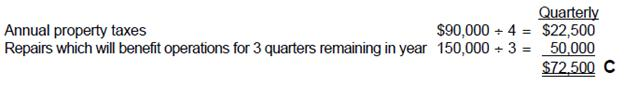

On March 15, 1992, Krol Co. paid property taxes of $90,000 on its office building for the calendar year 1992. On April 1, 1992, Krol paid $150,000 for unanticipated repairs to its office equipment. The repairs will benefit operations for the remainder of 1992. What is the total amount of these expenses that Krol should include in its quarterly income statement for the three months ended June 30, 1992?

Answer : C

Rule: Actual and estimated expenditures benefiting all interim periods equally should be expensed ratably throughout the year.

Choice 'c' is correct. $72,500 total expense for the three months ended June 30, 1992.

Tack, Inc. reported a retained earnings balance of $150,000 at December 31,1990. In June 1991, Tack discovered that merchandise costing $40,000 had not been included in inventory in its 1990 financial statements. Tack has a 30% tax rate. What amount should Tack report as adjusted beginning retained earnings in its statement of retained earnings at December 31, 1991?

Answer : B

Choice 'b' is correct. $178,000.

While preparing its 1991 financial statements, Dek Corp. discovered computational errors in its 1990 and 1989 depreciation expense. These errors resulted in overstatement of each year's income by $25,000, net of income taxes. The following amounts were reported in the previously issued financial statements:

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial statements?

Answer : C

Choice 'c' is correct. 1990 ($25,000) $125,000

1991 -- 180,000

Because these are comparative financial statements, prior period adjustments require retroactive treatment for the years presented. Because 1989 is not presented, the 1989 correction is shown as a prior period adjustment of $25,000 to retained earnings statement of 1990.