Acams CAMS-FCI Advanced CAMS-Financial Crimes Investigations Exam Practice Test

Online payments from a customer's account to three foreign entities trigger an investigation. The investigator knows the funds originated from family real estate after an investment company approached the customer online. Funds were remitted for pre-lPO shares. Which should now occur in the investigation?

Answer : C

The correct answer is C because reviewing the structure of the transactions to the three entities can help the investigator to identify any red flags or indicators of fraud, such as unusual amounts, frequency, destinations, or beneficiaries. The other options are not as relevant or effective in this scenario. Option A is not necessary because the investigator already knows the source of funds for the customer. Option B is not advisable because contacting the customer directly may alert them to the investigation and compromise its integrity. Option D is not helpful because inspecting electronic banking login records does not provide any information about the nature or purpose of the transactions.

Advanced CAMS-FCI Study Guide, page 281

Financial Crime Typologies - Intermediate Certificate Course, Module 32

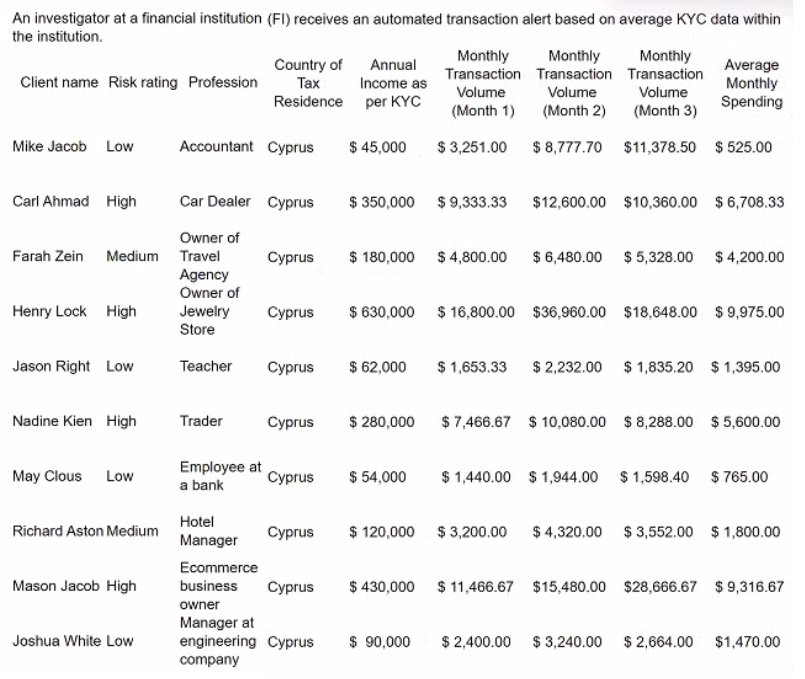

Refer to the exhibit.

In a review of the account activity associated with Nadine Kien, an investigator observes a large number of small- to medium-size deposits from numerous individuals from several different global regions. The money is then transferred to a numbered company. Which is the next best course of action for the investigator?

Answer : B

The next best course of action for the investigator is to file a SAR/STR on the account activity in relation to a potential funnel account. This is because a funnel account is a type of money laundering scheme that involves depositing funds from multiple sources into a single account, and then transferring them to another account, often in a different jurisdiction. A funnel account can be used to conceal the origin, ownership, and destination of illicit funds, and to evade currency transaction reporting requirements. The investigator should report the suspicious activity to the relevant authorities and document the findings and actions taken. The other options are incorrect because:

A . Completing the monthly review and noting the activity for next month's review is not sufficient, as it delays the reporting of a possible money laundering scheme and exposes the financial institution to regulatory and reputational risks.

C . Recommending the account for exit due to frequent global transactions is not appropriate, as it does not address the underlying issue of potential money laundering and may alert the customer of the investigation.

D . No further action is required as the customer is already rated at high-risk and the monthly spending is within expectations is not acceptable, as it ignores the red flags of a funnel account and fails to comply with the anti-money laundering obligations of the financial institution.

Advanced CAMS-FCI Certification | ACAMS, Section 2: Investigating Financial Crimes, page 9

Leading Complex Investigations Certificate | ACAMS, Module 2: Identifying Red Flags, page 5

While each is potentially important, which allows an investigations analyst to better write a SAR/STR narrative that is useful to law enforcement? (Select Two.)

Answer : D, E

A SAR/STR narrative that is useful to law enforcement should include a detailed description of the known or suspected criminal violation or suspicious activity, as well as ensure that all information in the SAR/STR is complete and accurate based on what the institution knows. These elements help law enforcement to understand the nature and scope of the suspicious activity, and to follow up with further investigation if needed. The other options are not essential for a useful SAR/STR narrative, as they either provide irrelevant or redundant information, or could compromise the confidentiality of the report.

A national financial intelligence unit (FIU) is undertaking the country risk assessment for the financing of the proliferation of weapons of mass destruction (WMD). The evaluation involves determining the exposure that financial institutions (FIs) have to operations that evade sanctions. Which should be performed by the FIU to assess proliferation financing risk? (Select Two.)

Answer : B, D

The FIU should cross-reference the databases of international commerce/logistics transactions between the country and WMD proliferation sanctioned states with the corresponding international financial operations of those transactions, as this would help identify any discrepancies or anomalies that could indicate sanctions evasion. The FIU should also evaluate a sample of the amount of false-positive and false-negative alerts that FIs have regarding proliferation sanctions evasion to determine root causes of non-detection, such as inadequate screening systems, lack of training, or human error. These actions would help the FIU assess the proliferation financing risk and provide feedback and guidance to FIs on how to improve their detection and prevention capabilities.

When writing or reviewing a SAR/STR, it is important to:

Answer : A

The correct answer is A because a SAR/STR narrative should be concise, clear, and complete, addressing the who, what, when, where, why, and how of the suspicious activity. Option B is incorrect because providing too much information can make the narrative confusing and irrelevant. Option C is incorrect because the introduction should provide a summary of the suspicious activity, not the conclusion. Option D is incorrect because suspect names should be mentioned in the narrative to identify the parties involved in the suspicious activity.

How does the Financial Action Task Force (FATF) measure the effectiveness of a country's efforts to combat money laundering and terrorist financing?

Answer : A

'The FATF measures the effectiveness of a country's efforts to combat money laundering and terrorist financing through a mutual evaluation process. During a mutual evaluation, the FATF assesses a country's legal and institutional framework, its implementation of measures to combat money laundering and terrorist financing, and the effectiveness of its efforts. The FATF then issues a report with recommendations for improvement' [CAMS Study Guide 6th edition, page 15-16].

As part of an internal fraud investigation, an AML officer has decided to interview an employee. Which statement is most consistent with best practices?

Answer : A

As part of an internal fraud investigation, an AML officer should gather information on the employee from coworkers and supervisors before the interview, as this can help to establish a baseline of the employee's behavior, role, and responsibilities, and identify any red flags or anomalies. The other options are not consistent with best practices because they can compromise the integrity of the investigation, violate the employee's rights, or discourage cooperation.