AAFM GLO_CWM_LVL_1 Chartered Wealth Manager (CWM) Global Examination Exam Practice Test

During ''Early accumulation'' life stage, typical asset allocation should be

Answer : B

Which of the following statement is true?

Answer : D

Intrinsic value of a stock is

Answer : B

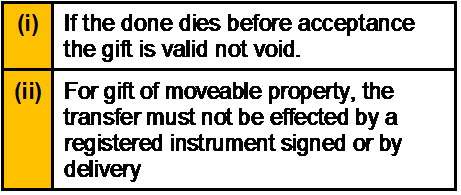

Which of the following statement is/are correct?

Answer : A

CAMELS framework was first used in _______.

Answer : D

Sunil insured the building of his house for a sum of Rs.500000 against fire insurance. One day the house is totally gutted in a devastating fire. The insurance surveyors certified that the building is a total loss with no salvage value and that the insurable value of the building just prior to the loss was Rs.1000000. The insurer will pay to Sunil:

Answer : C

The first Mutual fund to offer Sarahia complaint fund IS

Answer : C