AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination Exam Practice Test

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Bhatia owns a Maruti Wagonr with a monthly EMI of Rs. 6,312. The above loan will be completely repaid by August 2008. Mr. Bhatia planning to purchase a new car worth of Rs. 15 lakh. For this he has to take a full value loan of the car with 9% interest for 5 years. But his present car is in good condition and life of this car is approximately another 5 years repairs and maintenance cost are minimum. If he postpones his car purchasing plan now and deposit the same EMI outflow required for new car into an SIP with a minimum 15% yield for the next five years, then calculate the fund he can accumulate?

Answer : B

Section C (4 Mark)

Read the senario and answer to the question.

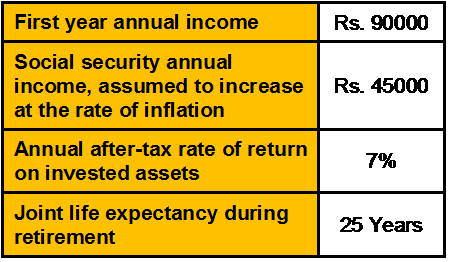

One commonly used method of calculating the total retirement fund necessary on the first day of retirement is to use the present value of an annuity due. The Pandeys' anticipate that their annual retirement income will need to increase each year at the rate of inflation. Based on the following assumption, calculate the total amount needed to be in place when Shanker and Parvati retire (Round to the nearest Rs. 1000)

Answer : C

Section C (4 Mark)

Read the senario and answer to the question.

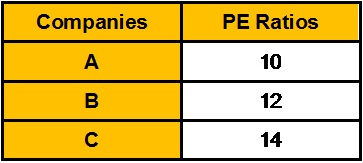

Mrs. Deepika's brother is impressed with Manav Fashion Ltd. an online clothing firm that focuses on the 18--22 age bracket. Their prices are much lower than their competitors, and the quality is high. Reading about the firm on its web site and in various financial newspapers, her brother has learned that the company plans to expand its clothing lines. The prevailing price of its share is 70 per share. Manav Fashion Ltd. has had recent annual earnings of Rs. 5 per share. Only three other companies have very similar business to Manav Fashion Ltd. and have stock that is traded and there PE ratios are as follows:

Her brother asked Mrs. Deepika to guide him in investing the Manav Fashion Ltd. Getting the query from her brother Mrs. Deepika asks your advice on this matter. As a Chartered Wealth Manager what will be your advice?

Answer : D

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the return on Jogen's investments in SBI Ltd shares.

Answer : B

Section C (4 Mark)

Read the senario and answer to the question.

Keshav purchased a Health Insurance. The policy has a calendar-year deductible of Rs. 500 and 80:20 as coinsurance. Keshav was hospitalized with a covered illness on January 23rd 2009. This hospitalization was his first claim under the said policy for the calendar year. His covered medical expenses were Rs. 20,500. How much of this amount will the insurer pay and how much will Keshav be required to pay to the Hospital?

Answer : D

Section C (4 Mark)

Read the senario and answer to the question.

Keshav average purchase rate of Infosys share is Rs. 1,000/- per share. At present it is Rs.2,000/- per share. He wants to protect his gains. What would you advise him as the best Option? Assume Rate of 2010 Call is Rs 50, 2010 Put is Rs.55, 1980 Call is at Rs.60 and 1980 Put is at Rs.63. Assume that ten days are left for expiry of the Option.

Answer : C

Section C (4 Mark)

Read the senario and answer to the question.

Harish incurred Rs. 10 Lakh on the construction of his house five years ago which has depreciated today to Rs. 7 Lakh. The cost of construction over the period has gone up by 70%.The depreciated value of household items is Rs. 2.5 Lakh and their present cost of replacement is Rs. 4 Lakh. Harish wants to buy a Householders' insurance policy in such a way that the house is insured on reinstatement basis and household goods on the basis of written down value. How much total insurance coverage should he take from the insurance company?

Answer : B