AAFM CTEP Chartered Trust & Estate Planner (CTEP) Certification Examination Exam Practice Test

Which of the following statement(s) is/are correct?

Answer : D

__________________ is used to show what Inheritance tax is due when someone has died and _________________ is used to show what Inheritance tax is due from lifetime events.

Answer : C

_____________ is for Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and___________ if for Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding.

Answer : B

There is no overall limit on how much a person can have invested in ISA accounts, but additional investments are currently limited to ________per person per year: a maximum of _________ in cash funds, with the balance being allocated either to mutual funds (Units Trusts and OEICs) or individual self-selected shares.

Answer : C

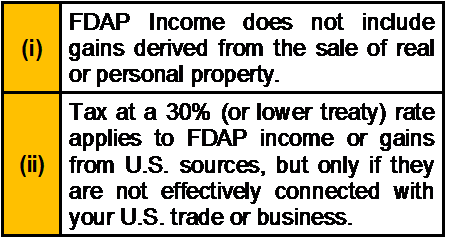

Which of the following statement(s) about FDAP Income is/are correct?

Answer : C

For inheritance tax purposes, even if the individual was not at the time of transfer domiciled in the UK, he or she will be treated as domiciled in the UK if, at the time a transfer of value was made:

Answer : C

In US, the amount of standard deduction is __________ for married individuals filing a separate return.

Answer : A